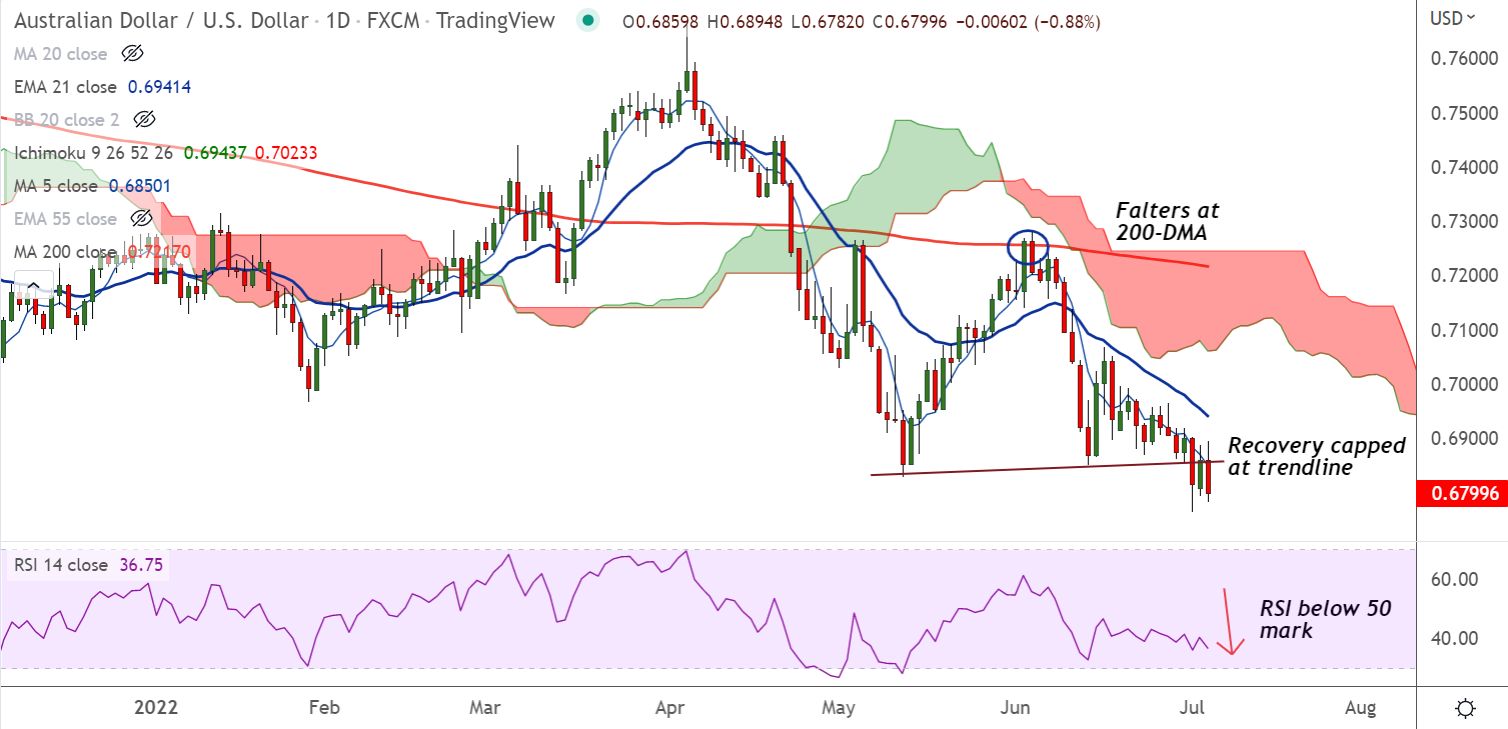

Chart - Courtesy Trading View

Technical Analysis:

- AUD/USD was trading 0.14% higher on the day at 0.6809 at around 08:40 GMT

- The pair trades with a bearish bias, refreshes 2-year lows below 0.68 handle

- Momentum is strongly bearish, Stochs and RSI are highly at oversold levels

- Price action is below major moving averages which are trending lower

- 'Death Cross' (bearish 50-DMA crossover on 200-DMA) on the daily charts keeps bias lower

Major Support Levels: 0.6768 (Lower BB), 0.67

Major Resistance Levels: 0.6835 (5-DMA), 0.6928 (21-EMA)

Summary: AUD/USD trades with a bearish bias. Scope for further weakness below 0.68 handle.