Chart - Courtesy Trading View

Technical Analysis:

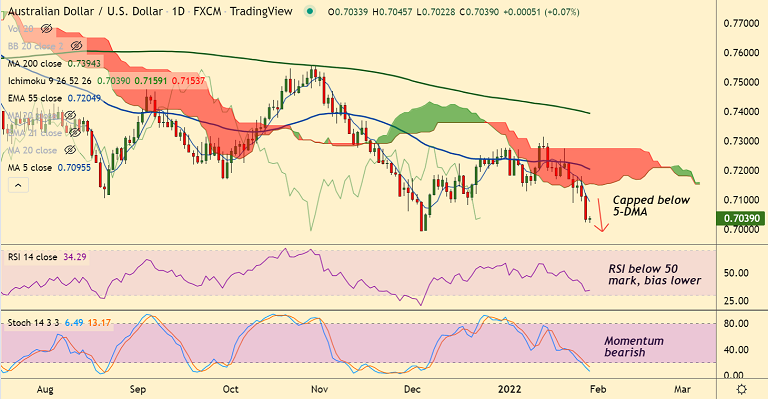

GMMA Indicator

- Major and minor trend are strongly bearish on the daily charts

Ichimoku Analysis

- Price action is extending break below daily cloud

- Chikou span is biased lower, supports further weakness

Oscillators

- Stochs and RSI are sharply lower, RSI is well below 50 mark

- Stochs are at oversold, but no signs of reversal seen

Bollinger Bands

- Bollinger bands are wide and suggest high volatility

Major Support Levels: 0.7022 (Lower W BB), 0.6993 (2021 lows), 0.6865 (Lower M BB)

Major Resistance Levels: 0.7095 (5-DMA), 0.7163 (converged 200-week MA and 200H MA), 0.7180 (20-DMA)

Summary: AUD/USD is extending break below 200-week MA and 38.2% Fib, scope for dip till 0.6993.