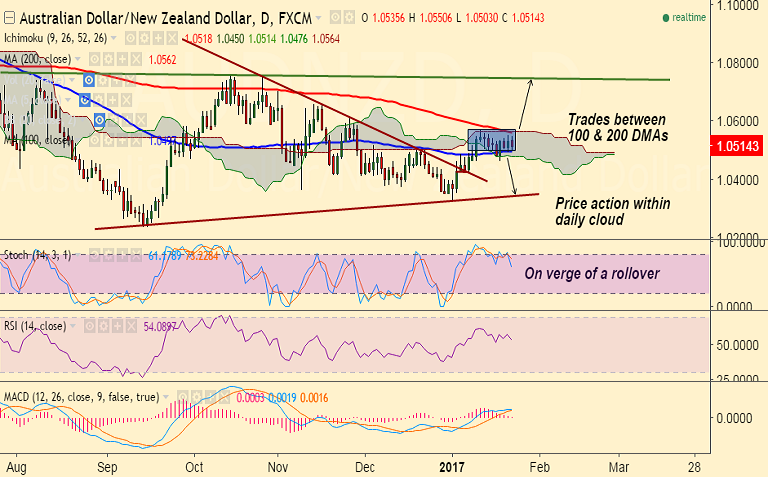

- AUD/NZD price action ranges between 100 and 200-day moving averages.

- The pair trades without clear directional bias, with price action raging within daily Ichi cloud.

- Breakout on either side required to indicate further direction.

- Some weakness seen on daily charts, with Stochs on the verge of a bearish rollover from overbought zone.

- Break below 100-DMA with confirmation on Stochs rollover and RSI slipping below 50 will accentuate weakness.

- On the flipside, breakout above 200-DMA at 1.0562 will see test of 1.0745 (major trendline).

- Support levels - 1.0496 (100-DMA), 1.0476 (cloud base), 1.0470 (20-DMA)

- Resistance levels - 1.0562 (200-DMA and cloud top), 1.0612 (Nov 25 high), 1.0655 (Nov 16 high)

Recommendation: We prefer to wait for confirmation to initiate shorts.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at 48.133(Neutral), while Hourly NZD Spot Index was at -35.56 (Neutral) at 0555 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.