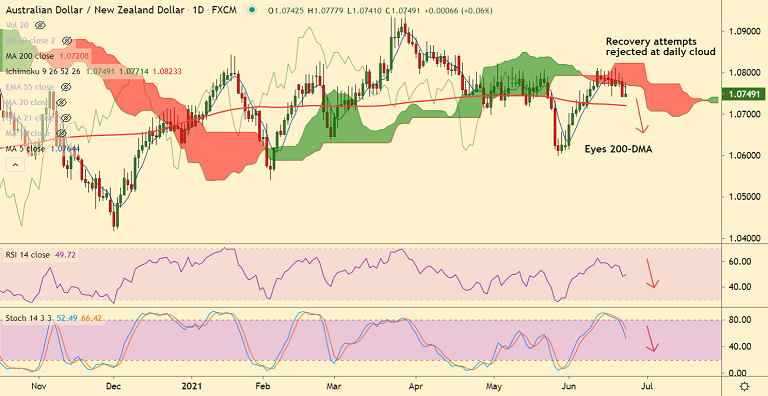

AUD/NZD chart - Trading View

Technical Bias: Bearish

- AUD/NZD was trading 0.08% higher on the day at 1.0750 at around 11:30 GMT

- Recovery attempts were capped at daily cloud, upside lacks traction

- 5-DMA has turned, price action has slipped below 200H MA

- Stochs confirm a bearish rollover from overbought levels, RSI is below 50

- Volatility is high as evidenced by wide Bollinger bands

Support levels - 1.0732 (20-DMA), 1.0720 (200-DMA), 1.0682 (50% Fib)

Resistance levels - 1.0764 (5-DMA), 1.08, 1.0823 (Cloud top)

Summary: AUD/NZD recovery attempts capped at daily cloud. The pair is currently on track to test of 200-DMA at 1.0720. Breach below 200-DMA will open further downside.