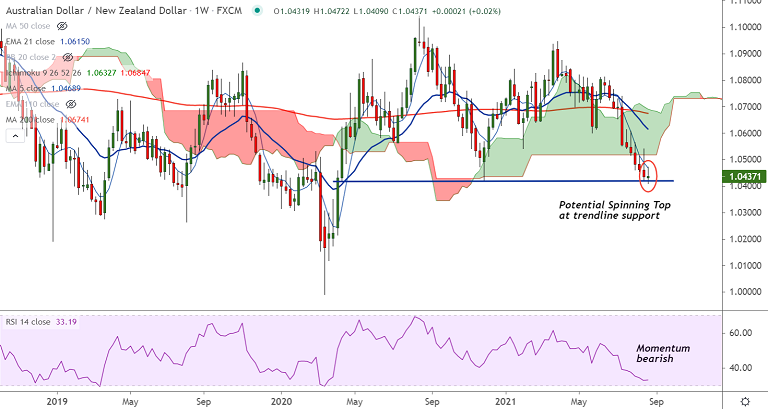

AUD/NZD chart - Trading View

Technical Analysis: Bias Bearish

- AUD/NZD is on track to close the week with a Spinning Top formation

- Price action has paused 6 week's bearish streak at major trendline support at 1.0420

- A potential Spinning Top formation shows bears struggling to take prices lower

- GMMA indicator shows major and minor trend are strongly bearish on the daily charts

- Price action is below daily cloud and major moving averages, momentum indicators support weakness

- MACD is well below the zero mark and ADX supports downside

Support levels - 1.0420 (trendline), 1.0397 (Lower W BB), 1.0307 (Jan 2020 low)

Resistance levels - 1.0442 (5-DMA), 1.0466 (200H MA), 1.0487 (21-EMA)

Summary: AUD/NZD trades with a major bearish bias. The pair is struggling to break major trendline support at 1.0420.

Recovery attempts lack traction. Decisive break above 21-EMA could change near-term dynamics. Break below 1.0420 will plummet prices.