NZ trade data for March is out. A small surplus (similar to Feb’s $217m) is expected, an increase in exports outpacing higher imports.

AUDNZD has been oscillating between a tight range of 1.1425 and 1.0190 levels, but in near term rising towards the 1.0750 areas, correcting several months of AUD underperformance.

Medium-term perspectives: Appears to have made a medium-term bottom at 1.0488 in April, and should extend towards 1.0900 which is the fair value according to interest rates and commodity prices.

Accordingly, just two weeks ago, we at FxWirePro have well anticipated the potential slumps of AUDNZD and advised options strips as a hedging strategy accordingly when the underlying spot FX was at around 1.0610 levels, that contained 3 legs. Of which 2 lots of 2m at the money put options and 1 lot of at the money call option of similar expiration. It has tumbled upto 1.0488 levels in the recent past.

The current spot FX reference is again spiking higher at 1.0687 levels, thereby, one can easily make out how much positive cashflow the above-stated strategy would have fetched in regardless of the swings.

Well, we are quite firm with our medium-term perspective, we could still foresee the potential for a further decline towards 1.0425 during this week and 1.0370 also, and given recent interest rate and commodity movements have slightly favored the NZD. Further out, it could target 1.08 also on the flip side which is close to fair value.

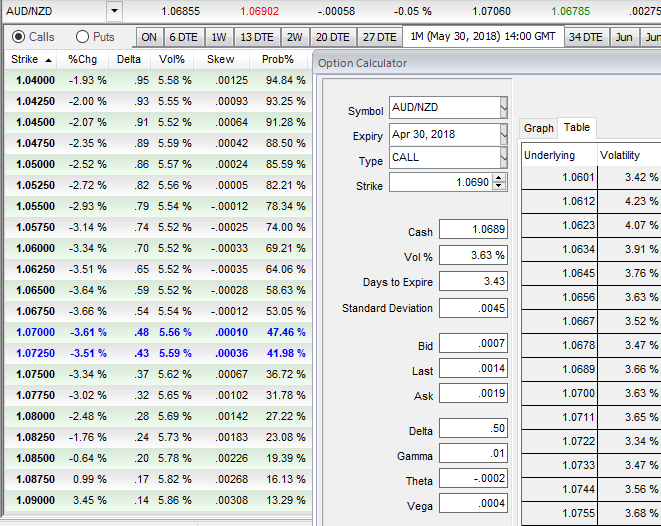

Please be noted that the positively skewed IVs of 1m tenors are balanced on either side, signals underlying risks are stretched towards both OTM call and OTM puts. This’s the reason why we advised options strips of diagonal expiry that keeps FX risks on the check regardless of the swings. We’ve seen the bearish impact on underlying AUDNZD movement in the major trend. Technically, the price behavior has been weaker with both leading as well as lagging indicators are bearish bias.

Contemplating all the fundamental driving forces and the ongoing technical trend of this pair, to participate in the puzzling swings, we advocate option strips strategy that contains 3 legs of vega longs (2 puts plus 1 call). As you could spot out IV skews are well balanced on either side (on both put/call), the option strips that likely to fetch desired yields regardless of the trend but more potential on southwards by arresting bearish risks.

The execution goes this way: Initiate 2 lots of 2m longs in Vega put options, simultaneously, add 1 lot of Vega call options of 1m expiry, the strategy is executed at net debit.

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing at -5 levels (which is neutral), while hourly NZD spot index was at shy above 17 (neutral) while articulating (at 03:41 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics