Glimpse over fundamental outlook: Please be noted that NZD also appears vulnerable on the crosses. In this regard, the rally in AUDNZD from the June low suggests a renewed trending bias and growing risk of an extension above the critical March high (1.1023), which would have medium term upside implications.

Steady softening in domestic data, AUDNZD has rallied considerably (about more than 3.5%) from its mid-year trough. Now the conviction is that large upside traction for AUDNZD seems to be capped some extent from here as both central banks (RBA & RBNZ) look reconciled to a strategy of nervously, but passively observing housing market wobbles, and relying on strong growth to eventually get inflation back on track.

AUDNZD minor trend has been little bearish (in short run) amid major trend sensing consolidation phase.

OTC Outlook & Option Strategy:

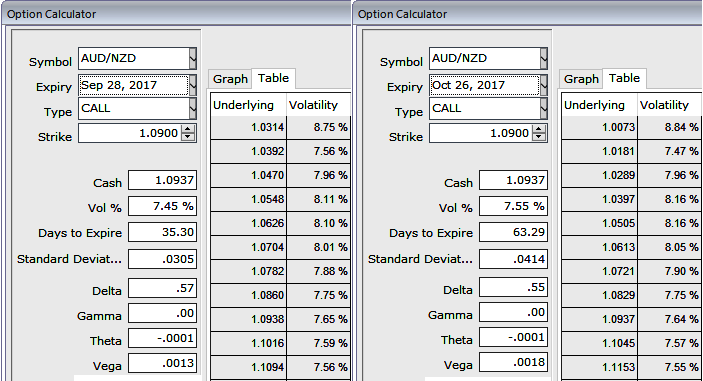

ATM IVs of AUDNZD is trading between 7.45 and 7.55% for 1 and 2m tenors respectively.

Mind you, the options with higher IVs usually would be expensive; in this case, IVs seem to be stable between 1 and a 2m expiry which is why in this case ATM puts have been preferred over OTM instruments on long leg.

Because OTM instruments need more vols on or before expiry, this is intuitive due to the higher likelihood of the market ‘swinging’ in your favour. If IV increases and you are holding an option, this is good. When you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

Thus, on hedging grounds, conservative hedgers can prefer the below strategy regardless of the swings in the underlying spot FX:

Diagonal Credit Call Spread = Go long 2M ATM 0.51 delta call option, simultaneously, short (2%) ITM call with positive theta.

For a net credit, bear call spread reduces the cost of trade by the premium collected (on the shorts of ITM strikes) and keeps option trader to participate in momentary downswings and further bullish risks in the major trend.

Moreover, the risk is capped to the extent of initial premium paid, as opposed to unlimited risk when short selling the underlying outright.

However, call options have a limited lifespan. If the underlying FX price does not move above the strike price before the option expiration date, the call option will expire worthless.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data