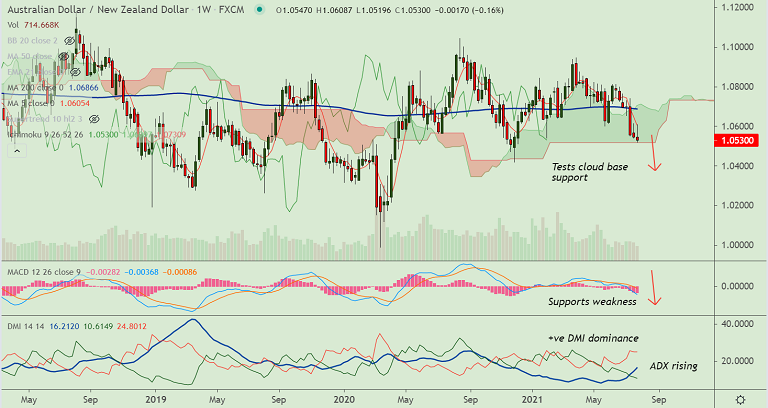

AUD/NZD chart - Trading View

Technical Analysis: Bias Bearish

- AUD/NZD was trading 0.10% lower on the day at 1.0530 at around 12:25 GMT

- Volatility is high and rising on the daily and weekly charts as evidenced by widening Bollinger bands

- GMMA indicator shows major and minor trend are strongly bearish on the daily charts

- MACD is well below zero and ADX is rising in support of downside

- The pair hovers around weekly cloud base support, breach below will plummet prices

- A potential 'Death Cross' (bearish 50-DMA crossover on 200-DMA) keeps bias bearish

Support levels - 1.0517 (Weekly cloud base), 1.0483 (Lower BB), 1.0418 (Dec 2020 lows)

Resistance levels - 1.0552 (5-DMA), 1.0606 (21-EMA), 1.0670 (55-EMA)

Summary: AUD/NZD trades with a bearish bias. Price action is pivotal at weekly cloud support. Break below will plummet prices.