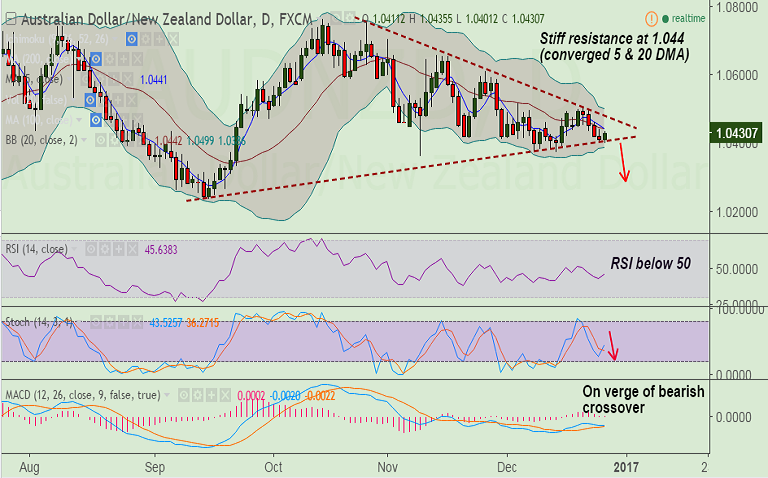

- AUD/NZD is trading a "Symmetric triangle" pattern.

- The pair has held triangle base support and edged higher.

- Upside finds stiff resistance at 1.044 (converged 5 & 20 DMAs).

- Series of resistance on the upside: Ichi cloud base (1.0501), 100-DMA (1.0501), Triangle top (1.0485).

- Price action pivotal at triangle base at 1.04, decisive break below will see drag upto 1.0237.

- On the flipside, breakout above 1.0501 could see test of 1.0612.

- Support levels - 1.04 (Triangle base), 1.0350 (78.6% Fib of 1.02371 to 1.07647 rally), 1.0312 (July 8 low)

- Resistance levels - 1.044 (converged 20 & 5 DMA), 1.0485 (Triangle top ), 1.0501 (cloud base & 100-DMA)

Recommendation: Good to sell rallies around 1.0435/45, SL: 1.0485, TP: 1.04/ 1.0375/ 1.0350

FxWirePro's Hourly AUD Spot Index was at -94.8233 (Highly Bearish), while Hourly NZD Spot Index was at -44.1223 (Neutral) at 0655 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.