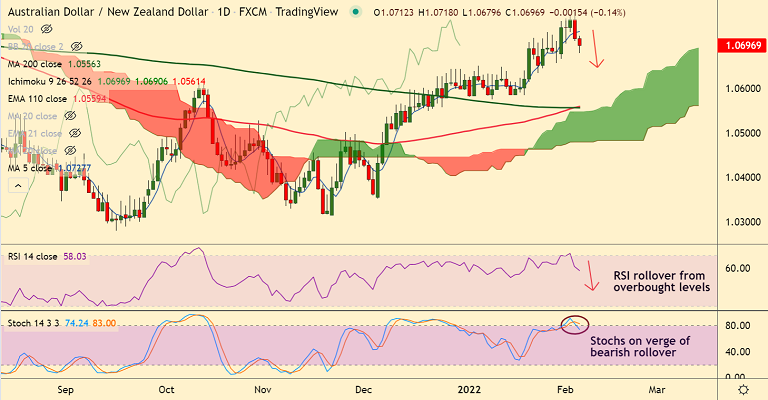

Chart - Courtesy Trading View

AUD/NZD was trading 0.14% lower on the day at 1.0697 at around 12:35 GMT.

The pair is in the red for the second straight session, price action has slipped below 200H MA.

RSI shows bearish rollover from overbought levels, Stochs are o verge of bearish rollover from overbought zone.

Chikou span is biased lower, suggesting further weakness in the pair. MACD is on verge of bearish crossover on signal line.

The Australian dollar came under some selling on Friday after RBA minutes indicated a patient approach.

The Reserve bank of Australia, in the Statement on Monetary Policy (SoMP) earlier on Friday, said that the board is prepared to be patient amid significant uncertainties surrounding the inflation outlook.

Support levels - 1.0669 (21-EMA), 1.0629 (200-week MA)

Resistance levels - 1.0713 (200H MA), 1.0728 (5-DMA)

Summary: AUD/NZD is poised for further downside, scope for test of 21-EMA at 1.0669.