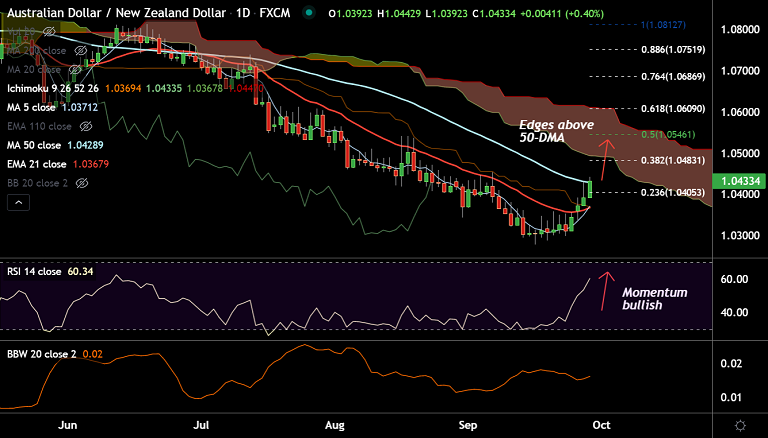

AUD/NZD chart - Trading View

Technical Analysis: Bias Bullish

- AUD/NZD is extending gains for the 4th consecutive session

- Price action has hit 3-week highs at 1.0442 before paring some of the gain to trade at 1.0433 at around 10:55 GMT

- The pair has broken above 23.6% Fib retracement and has paused at 50-DMA resistance at 1.0428

- Momentum is bullish, Stochs and RSI are sharply higher, RSI is well above 50 mark

- MACD supports gains with a bullish crossover on signal line

Support levels - 1.0405 (23.6% Fib), 1.0370 (nearly converged 5-DMA and 21-EMA), 1.0348 (200H MA)

Resistance levels - 1.0428 (50-DMA), 1.0483 (38.2% Fib), 1.0493 (cloud base)

Summary: AUD/NZD was trading with bullish momentum. Break above 50-DMA will see gains till daily cloud.