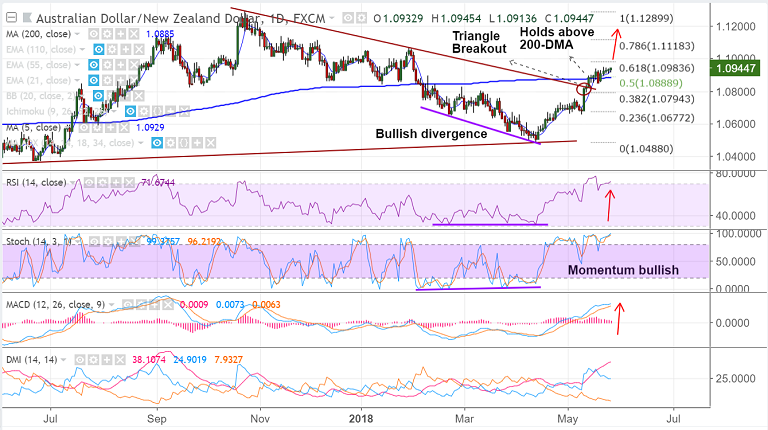

- AUD/NZD is extending gradual grind higher above 200-DMA, is on track to 61.8% Fib at 1.0984.

- Price action has shown a breakout of 'Symmetric Triangle' pattern and break above 200-DMA has raised scope for further upside.

- Trade tensions and geopolitical concerns and the resulting risk-off seems to have capped upside in the pair.

- Technical indicators support gains in the pair. We see bullish divergence on RSI and Stochs which adds to bullish bias.

- Next major bull target lies at 61.8% Fib at 1.0941. Break above targets 1.1072 (2018 highs till now).

- Downside finds immediate support at 5-DMA at 1.0928. Break below could see drag till 200-DMA.

- Break below 200-DMA could negate bullish bias. Weakness till 21-EMA likely.

Support levels - 1.0928 (5-DMA), 1.0885 (200-DMA), 1.0830 (21-EMA), 1.0794 (38.2% Fib)

Resistance levels - 1.0983 (61.8% Fib), 1.10, 1.1072 (2018 high)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-AUD-NZD-finds-major-resistance-at-10830-good-to-go-long-on-break-above-1306773) has hit TP1/2.

Recommendation: Bias higher. Hold for further upside.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at 125.127 (Bullish), while Hourly NZD Spot Index was at 67.1698 (Neutral) at 0900 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.