NZD was solid overnight. It is difficult to come up with likely catalysts for large moves in the NZD in the New Zealand session today, with no data or speeches due. The upward trend, which has been apparent since mid-January with the only down month being May, remains in place.

NZD initially rose from 0.7275 to 0.7335, consolidating to 0.7300. AUD/NZD extended a two-week old decline to 1.0413 – last seen on 11 July.

Monetary policy wise, both RBA and RBNZ has still got potential to cut policy rates.

Technically, bears managed to break supports at the neckline of the double top (at 1.0433 on daily charts). Despite minor upswings in a short run, the major declining trend is in conformity to the volumes and both leading lagging indicators.

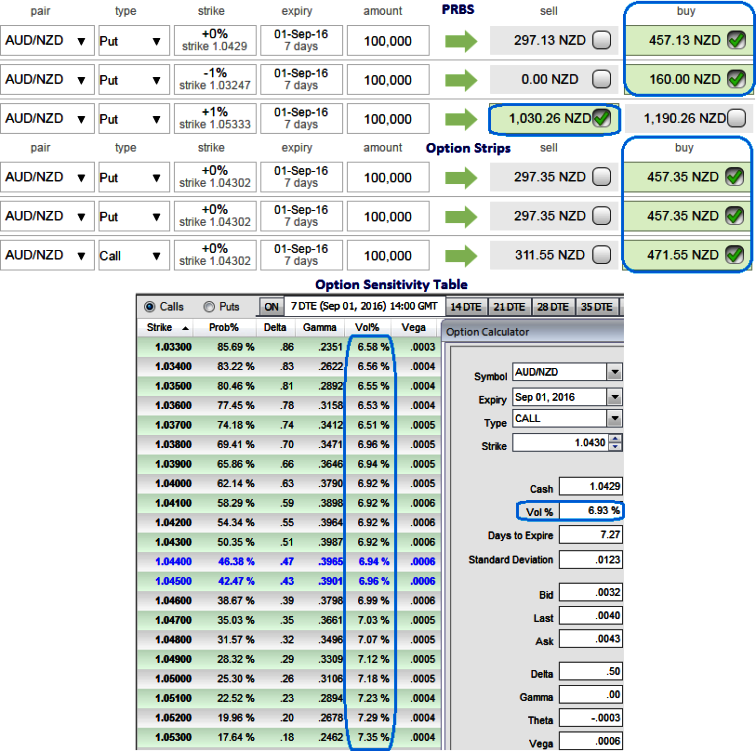

Well, in order to arrest this short term upside risk and major downtrend, we run you through the differential values between both option spreads and combination strategies contemplating FX OTC market indications.

1W at the money volatilities of 50% delta calls and puts are hovering between 6.5% - 7.5% which is reasonable as the vols currently are working in the interest of option writers as you can see IVs and corresponding movements in vega.

The current 1w IVs that favour underlying spot’s upside bias but through option writing rather than holding.

Please be noted that the cost of hedging reduces in the case of put ratio back spread, which is considerably lower than that of option strips strategy = NZD 1647.39 in the case of PRBS and NZD 1386.25 for option strips strategy, Hence, hedger can also achieve the cost advantage.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025