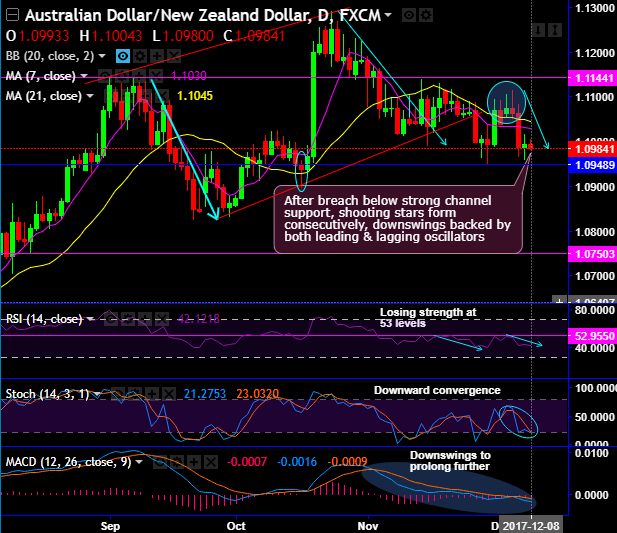

Ever since the channel support was breached, we’ve seen more bearish interests than the buying interests. Shooting stars occur at 1.1074 and 1.1062 levels consecutively (refer daily plotting), the downswings are backed by both leading & lagging oscillators on this timeframe.

The major trend of this pair has been downtrend that has gone into consolidation phase approximately from the last three years.

Upon failure swings at range resistance, the major trend has gone back in range, we expect the same range bounded trend to persist as the momentum indicators signal losing strength.

In short-term trend, the next stiff resistance is observed at 1.1030 and 1.1045 (i.e. 7&21DMA levels), and on the flip side, the strong support zone at 1.1048-1060 areas.

On a broader perspective, the bulls in the intermediary trend seem unlikely to break range resistances, expect the range bounded trend to persist as momentum indicators signal losing strength.

Overall, the resumption of major downtrend at any time cannot be ruled out, even if you witness any abrupt upswings, that shouldn’t be deemed as panicky buying sentiment.

Instead, one touch binary put options are advocated for the intraday speculative trades for bearish targets, this has been the conviction trade and it is wise to jack up speculative leveraged positions in order to fetch exponential yields than the spot moves.

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing at -66 levels (which is bearish), while hourly NZD spot index was at shy above 60 (which is bullish) while articulating (at 06:35 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: