FxWirePro's Hourly Currency Index bias for AUD/NZD at 0500 GMT: Bearish

FxWirePro's Hourly AUD Spot Index: -122.59 (Bearish)

FxWirePro's Hourly NZD Spot Index: 90.5586 (Bullish)

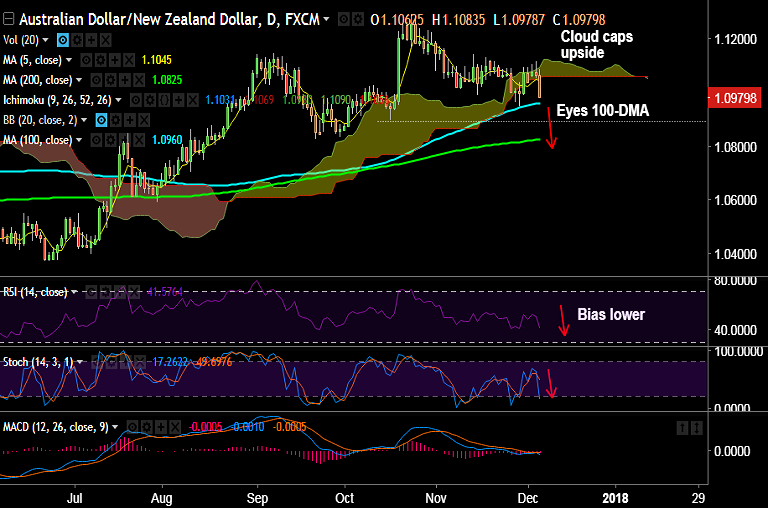

Technical Analysis: Bias Bearish

- Price action rejected at daily cloud

- Breaks below 5 and 20 day moving averages

- RSI has turned south and Stochs are biased lower

- Bearish divergence seen on RSI and Stochs on weekly charts

Data Drivers:

- Australia Q3 GDP data missed expectations

- +0.6 pct q/q, (forecasts +0.7 pct), +2.8 pct y/y (forecasts +3.0 pct)

Support levels - 1.0960 (100-DMA), 1.0887 (38.2% Fib retrace of 1.0237 to 1.1290 rally), 1.0825 (200-DMA)

Resistance levels - 1.1045 (5-DMA), 1.1051 (20-DMA), 1.1090 (cloud top)

Recommendation: Stay short for 100-DMA (1.0960). Watch out for break below for further downside. Target 1.090/ 1.0825.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest