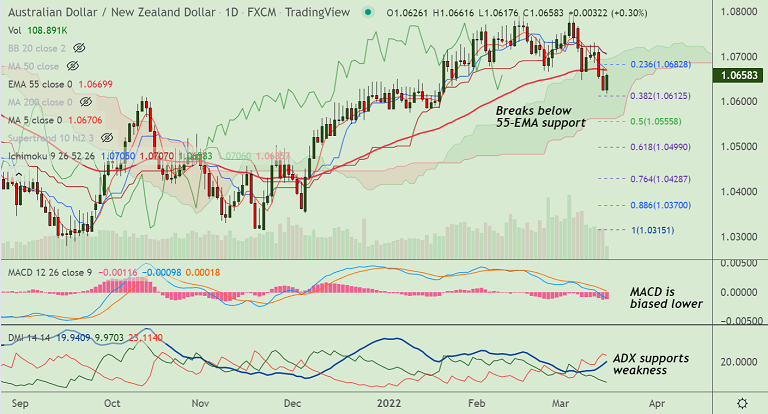

Chart - Courtesy Trading View

Technical Analysis: Bias Neutral

- AUD/NZD was trading 0.31% higher on the day at 1.0658 at around 11:00 GMT

- The pair has snapped a 2-day bearish streak and edged higher after holding 110-EMA support

- Price action is on track to form a 'Bullish Engulfing' pattern on the daily charts

- GMMA indicator shows minor trend has turned bearish. Price action has slipped below 200H MA

- Momentum indicators are bearish, volatility is high and rising

Support levels - 1.0621 (110-EMA), 1.06, 1.0554 (200-DMA)

Resistance levels - 1.0669 (55-EMA), 1.0697 (21-EMA), 1.0705 (20-DMA)

Summary: AUD/NZD was trading with a neutral bias. The pair is holding support at 110-EMA, break below will see further weakness. Dip till 200-DMA at 1.0554 likely.