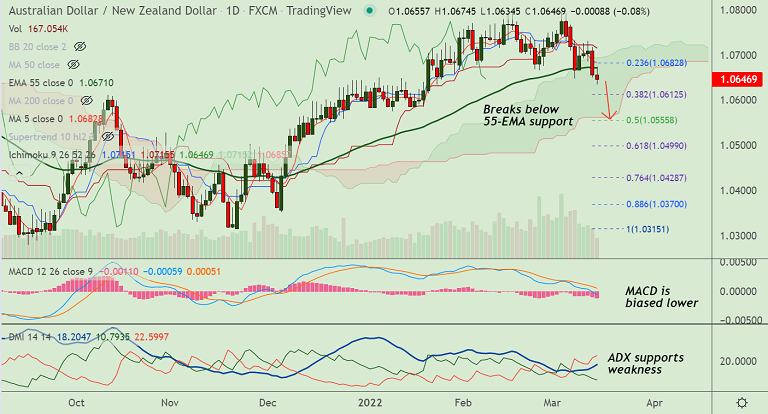

Chart - Courtesy Trading View

Technical Analysis: Bias Bearish

- AUD/NZD was trading 0.06% lower on the day at 1.0648 at around 13:30 GMT

- Price action has slipped below 55-EMA and is on track for further downside

- MACD is biased lower, ADX supports further weakness in the pair

- The pair has slipped into the daily cloud and RSI nicely converges with price action

- Momentum is bearish and rising volatility to drag prices lower

Support levels - 1.0620 (110-EMA), 1.06, 1.0555 (200-DMA)

Resistance levels - 1.0671 (55-EMA), 1.0682 (5-DMA), 1.0703 (21-EMA)

Summary: AUD/NZD trades with a bearish bias. Breach below 55-EMA has raised scope for further downside. Next bear target lies at 110-EMA at 1.0620.