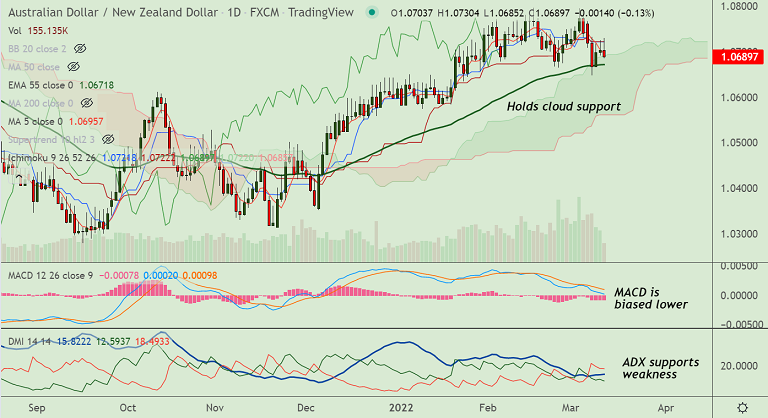

Chart - Courtesy Trading View

Technical Analysis: Bias Bearish

- AUD/NZD was trading 0.13% lower on the day at 1.0689 at around 13:15 GMT

- Recovery attempts in the pair have been capped below 200H MA

- The pair finds stiff resistance at 21-EMA, upside continuation only on break above

- GMMA indicator shows major trend is still bullish, cloud is offering strong support

- Stochs and RSI are biased lower, momentum is with the bears

Support levels - 1.0688 (Cloud top), 1.0672 (55-EMA), 1.0619 (110-EMA)

Resistance levels - 1.0713 (21-EMA), 1.0723 (20-DMA), 1.0728 (200H MA)

Summary: AUD/NZD trades with a bearish bias. Upside continuation only above 21-EMA.