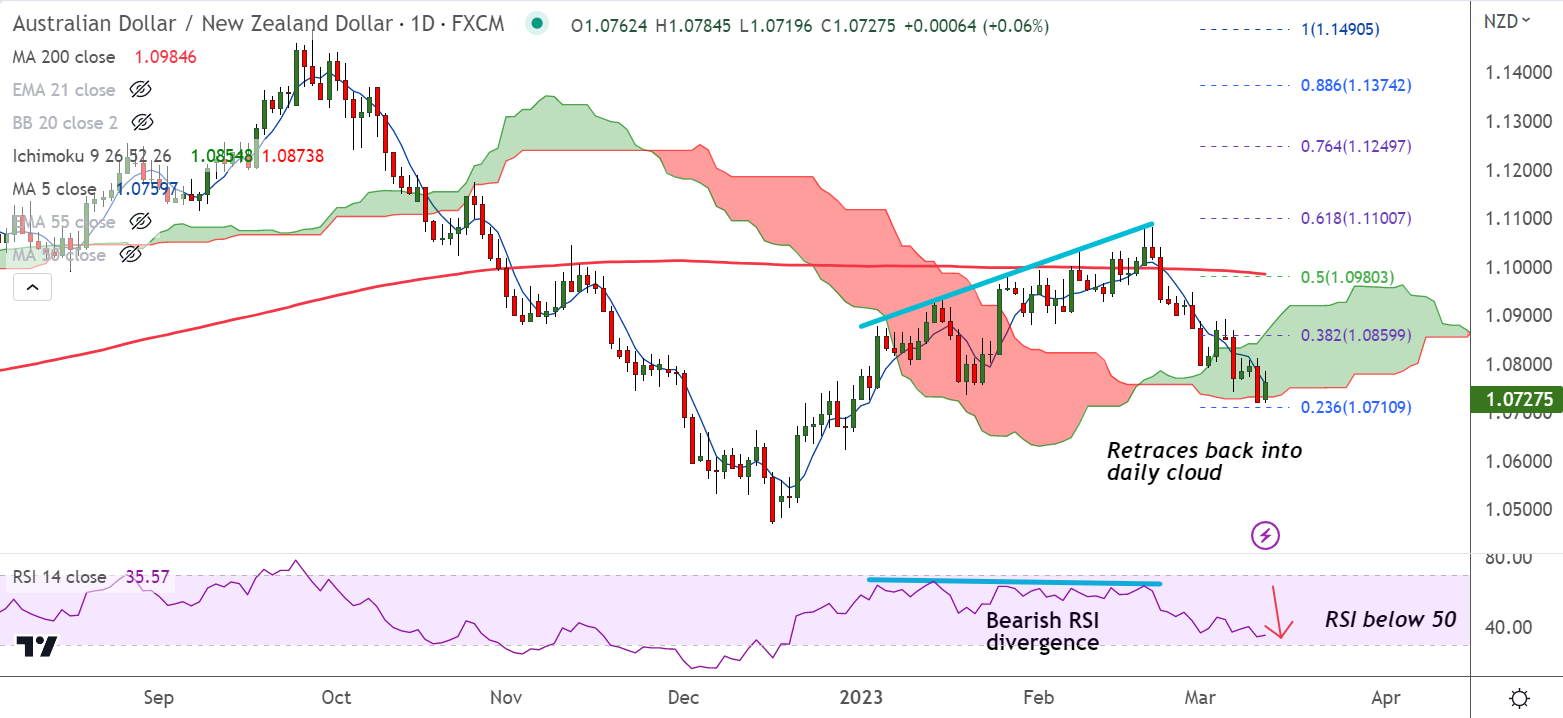

Chart - Courtesy Trading View

Technical Analysis:

- AUD/NZD was trading 0.08% higher on the day at 1.0728 at around 10:25 GMT

- Price action has retraced dip below daily cloud

- Momentum is still bearish, Stochs and RSI are biased lower

- Recovery attempts remain capped below 200H MA and 5-DMA

- MACD and ADX support downside in the pair, Chilou span is biased lower

Support levels:

S1: 1.0731 (Cloud base)

S2: 1.0700 (200-week MA)

Resistance levels:

R1: 1.0759 (5-DMA)

R2: 1.0809 (200H MA)

Summary: AUD/NZD recovery attempts lack traction. Technical analysis for the pair remains bearish. Scope for downside resumption. Breakout above 200H MA could change near-term dynamics.