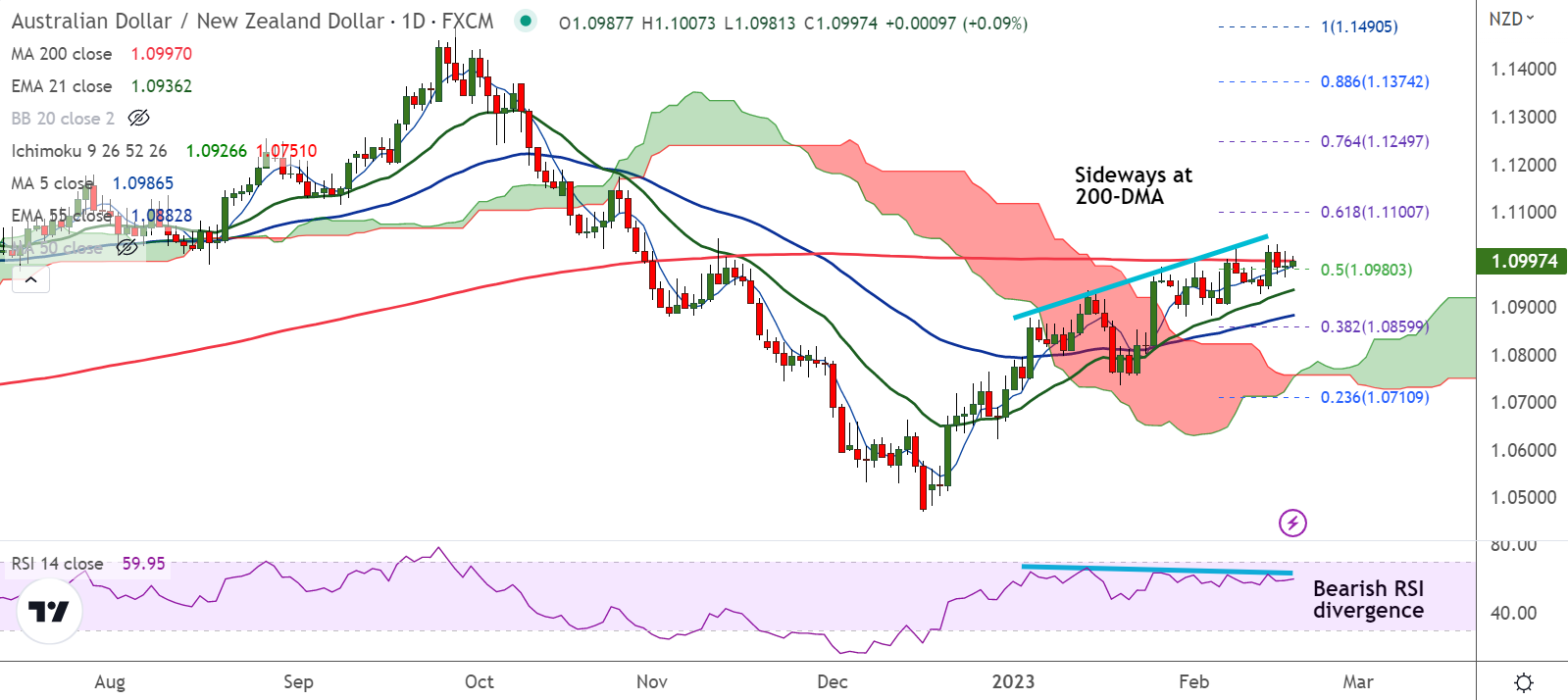

Chart - Courtesy Trading View

Technical Analysis:

- AUD/NZD was trading 0.15% higher on the day at 1.1004 at around 08:55 GMT

- The pair is extending choppy trade around 200-DMA, bias remains bullish

- GMMA indicator shows major and minor trend are bullish on the daily charts

- Price action is above cloud, Chikou span is biased higher, momentum is with the bulls

- Bearish RSI divergence on the daily chart exerts some pressure

Support levels:

S1: 1.0987 (5-DMA)

S2: 1.0936 (21-EMA)

Resistance levels:

R1: 1.0844 (Upper BB)

R2: 1.1100 (61.8% Fib)

Summary: AUD/NZD pivotal at 200-DMA. Decisive break above will propel the pair higher. Scope for test of 61.8% Fib at 1.11.