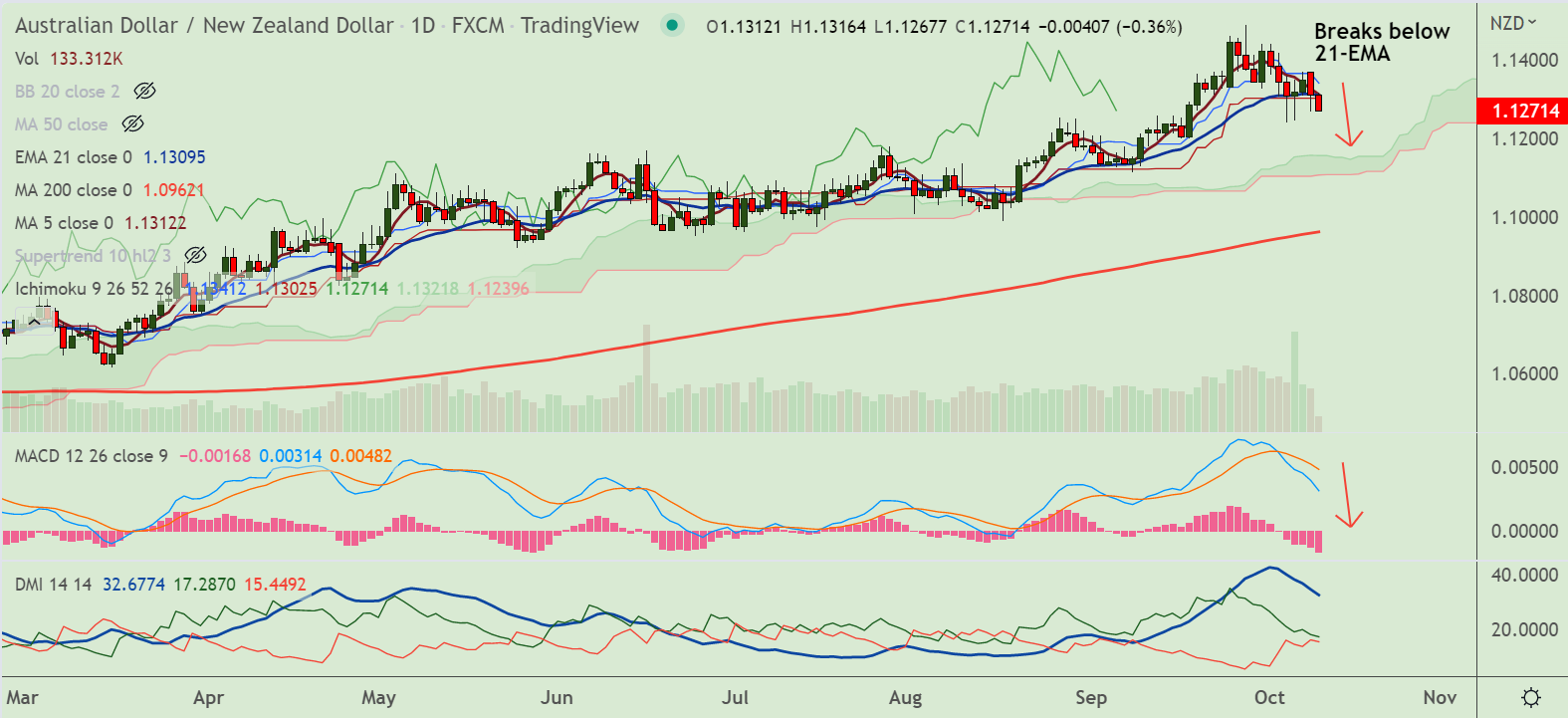

Chart - Courtesy Trading View

Technical Analysis:

- AUD/NZD was trading 0.37% lower on the day at 1.1269 at around 06:30 GMT

- The pair is extending previous session's weakness, slips below 21-EMA

- Momentum is bearish, stochs and RSI are sharply lower, RSI is below 50

- MACD confirms bearish crossover on signal line, Chikou span is biased lower

- Price action is below 200H MA, GMMA indicator shows bearish bias on the intraday charts

Support levels - 1.1223 (55-EMA), 1.1208 (Lower BB)

Resistance levels - 1.1309 (21-EMA), 1.1332 (20-DMA)

Summary: AUD/NZD trades with a bearish bias. Close below 21-EMA support will see more weakness in the pair.