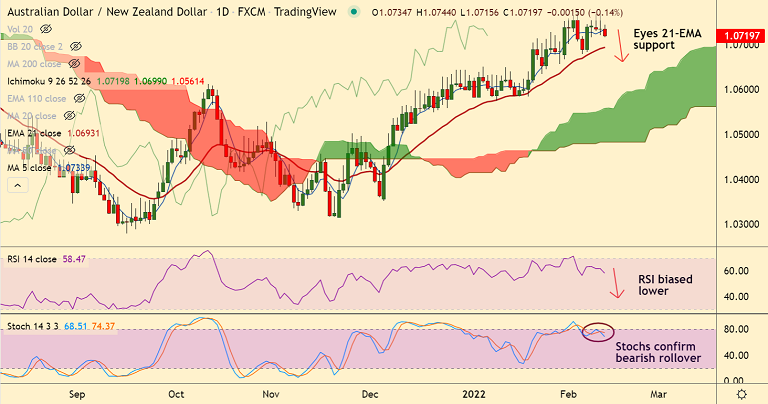

Chart - Courtesy Trading View

AUD/NZD was trading 0.16% lower on the day at 1.0718 at around 10:10 GMT.

After successive Doji's and Spinning Top formations on the daily candles at multi-month highs, the pair is poised for some pullback.

RSI and Stochs have confirmed bearish rollover from overbought levels, Chikou span is biased lower.

Price action has slipped below 200H MA and GMMA has turned bearish on the hourly charts.

Major trend in the pair remains bullish. Pullbacks are likely to be shallow. Major support is seen at 1.0693 (converged 20-DMA and 21-EMA).

Bullish bias intact as long as pair holds above 21-EMA support. Resumption of upside will see test of channel top at 1.0820.