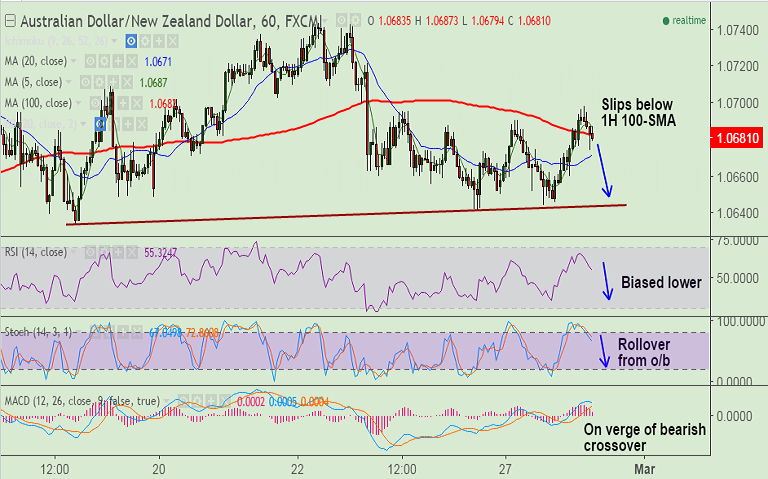

- AUD/NZD hovers around 1H 100-SMA at 1.0682.

- Technical indicators are biased lower, break below 100-SMA builds scope for downside.

- RSI is biased lower, Stochs have rolled over from overbought level

- MACD is on verge of bearish crossover on signal line, which if completed will provide further confirmation.

Support levels - 1.0671 (1H 20-SMA), 1.0610 (20-DMA), 1.0520 (200-DMA)

Resistance levels - 1.07, 1.0748 (Feb 22 high), 1.0765 (Oct 14 high)

TIME TREND INDEX OB/OS INDEX

1H Bearish Neutral

4H Neutral Neutral

1D Bearish Neutral

1W Bullish Neutral

Recommendation: Good to go short on rallies around 1.0680, SL: 1.0710, TP: 1.0645/ 1.0610/ 1.0570

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -61.1516(Bearish), while Hourly NZD Spot Index was at -30.1051 (Neutral) at 0650 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.