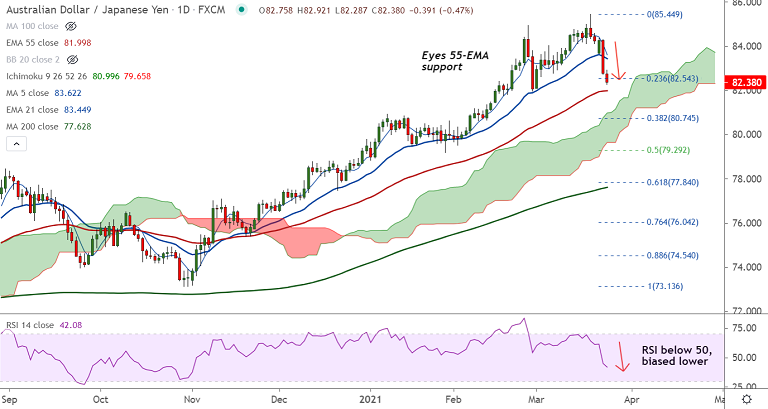

AUD/JPY chart - Trading View

AUD/JPY Spot Analysis (06:30 GMT):

Intraday High/Low: 82.92/ 82.28

Previous day's High/Low: 84.31/ 82.73

Previous week's High/Low: 85.44/ 84.11

Technical Analysis:

GMMA indicator: Major trend - Neutral, Minor trend - Bearish

Oscillators: Stochs and RSI are biased lower, RSI is below 50

Bollinger Bands: Wide and expanding on daily charts, suggesting rising volatility

Fundamental Overview: Risk-aversion remains at full steam weighing down the pair. Vaccine fears as well as geopolitical and trade worries emanating from China, North Korea dent sentiment.

Support and Resistance Levels:

Support: 81.99 (55-EMA) 80.74 (38.2% Fib)

Resistance: 83.45 (21-EMA) 84.28 (200H MA)

Summary: The spot looks to extend Tuesday’s 1.78% sell-off. Bears eye next immediate support at 55-EMA at 81.99. Breach below 55-EMA will see test of cloud support.