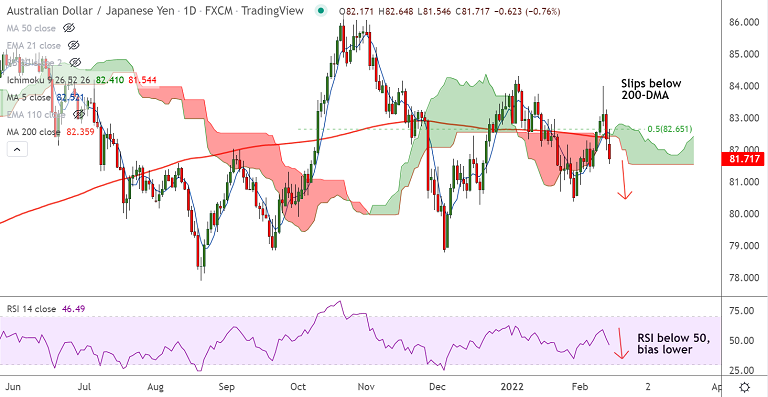

Chart - Courtesy Trading View

AUD/JPY plummets lower for the second straight session, retraces below cloud and 200-DMA.

The pair was trading 0.77% lower on the day at 81.70 at around 12:10 GMT, after closing 0.93% lower in the previous session.

Escalating fears over Russia’s invasion of Ukraine and bearish signals from the Commodity Futures Trading Commission (CFTC) weigh on the antipodeans.

Reserve Bank of Australia’s (RBA) recently bearish rhetoric keeps bearish pressure. Focus now on minutes from the RBA and Fed due Tuesday and Wednesday respectively.

Price action has slipped below 200H MA on the intraday charts. GMMA indicator shows bearish shift on the intraday charts.

Oscillators have turned bearish. RSI is below 50, Stochs are on verge of rollover from overbought levels.

Support levels - 81.34 (55-week EMA), 80.81 (Trendline support)

Resistance levels - 81.86 (20-DMA), 82.25 (200H MA)

Summary: AUD/JPY trades with a bearish bias. Watch out for break below 81.34 for further weakness. Dip till 80.80 likely.