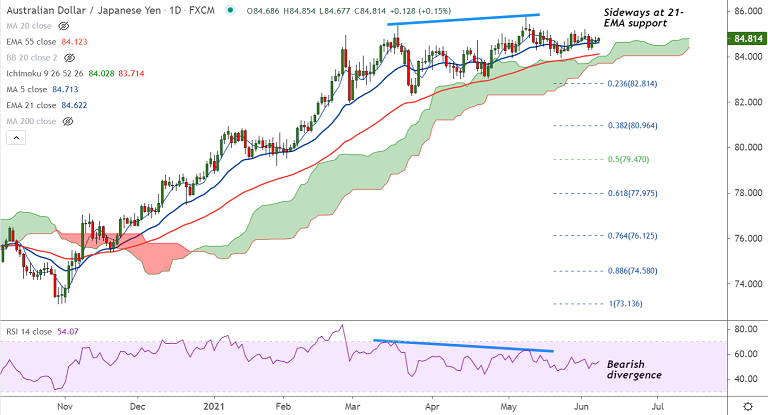

AUD/JPY chart - Trading View

AUD/JPY was trading 0.22% lower on the day at 84.691 at around 10:00 GMT, after closing 0.47% higher in the previous session.

The Reserve Bank of Australia (RBA) board’s rejection of rate-hike and tapering concerns along with downbeat market sentiment weigh on the pair.

The RBA minutes released earlier on Tuesday reiterated policymakers’ cautious mood. The board agreed it would be ‘premature to consider ceasing’ the bond-buying program.

200-month MA continues to cap upside in the pair for the 5-th straight month. Decisive break above required for upside continuation.

A 'Golden Cross' (bullish 50-SMA crossover on 200-SMA) on the weekly charts keeps scope for upisde.

Major technical bias for the pair remains bullish. Price action holds support at 50-DMA and daily cloud.

Scope for upisde resumption. Next major bull target lies at 88.6% Fib at 86.35. Break below cloud negates any further upisde.