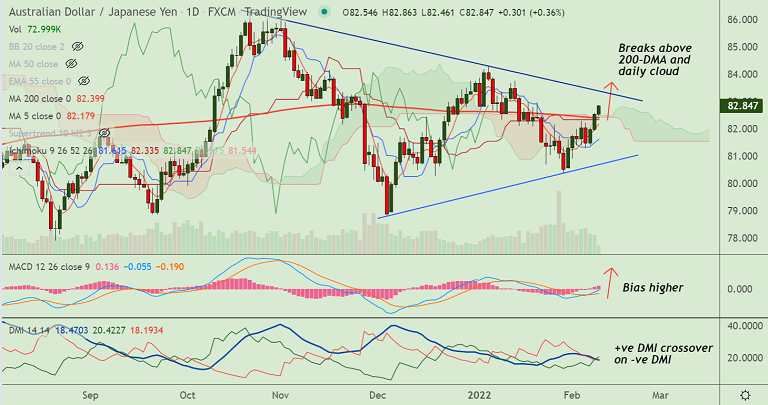

Chart - Courtesy Trading View

AUD/JPY was trading 0.36% higher on the day at 82.84 at around 10:50 GMT.

The pair closed above 200-DMA on Tuesday's trade, raising scope for further upside.

The Australian dollar buoyed on expectations of a hawkish stance from the RBA.

Markets have moved to price in more moves by the RBA, with the first move to 0.25% is implied by June. Further increases to 2.5% are priced in by July 2023.

Yields on Aussie 10-years have surged 25 basis points in four sessions to hit 2.10%, and briefly reached their highest since March 2019 at 2.157%.

Technical indicators show bullish bias. MACD confirms bullish crossover on signal line. GMMA indicator has turned bullish on the intraday charts.

Price action is in a 'Symmetric Triangle' pattern. Scope for test of Triangle top at 83.40. Bullish invalidation likely on retrace below 200-DMA.