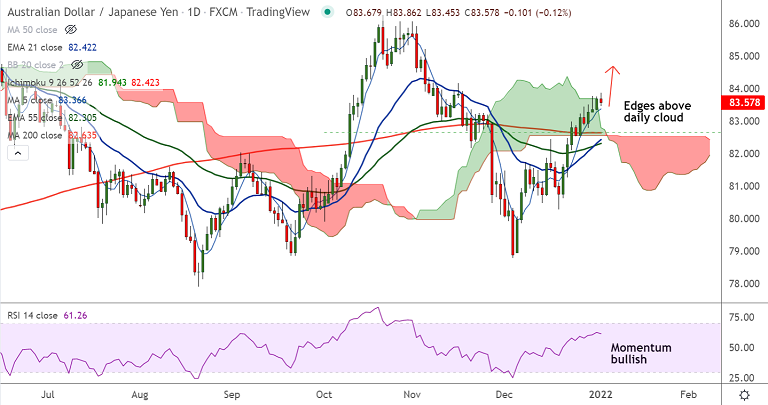

Chart - Courtesy Trading View

AUD/JPY was trading 0.11% lower on the day at 83.58 at around 04:15 GMT.

The pair is extending breakout above 200-DMA and has edged above the daily cloud.

Global risks related to COVID-19 is a cause for concern, given the rising numbers of infections and impacts of global growth due to renewed lockdowns.

Further, risks associated with the Chinese property development giant Evergrande Group amid reports of missed debt payments weigh on sentiment.

The pair has paused two straight weeks of solid gains, but technical outlook remains bullish.

GMMA indicator shows bullish bias. Volatility is high and momentum is strongly bullish on the daily charts.

5-DMA is immediate support at 83.36. Bullish invalidation only below 200-DMA. Bulls on track to retest 200-month MA at 84.77. Decisive break above 200-month MA will propel the pair higher.