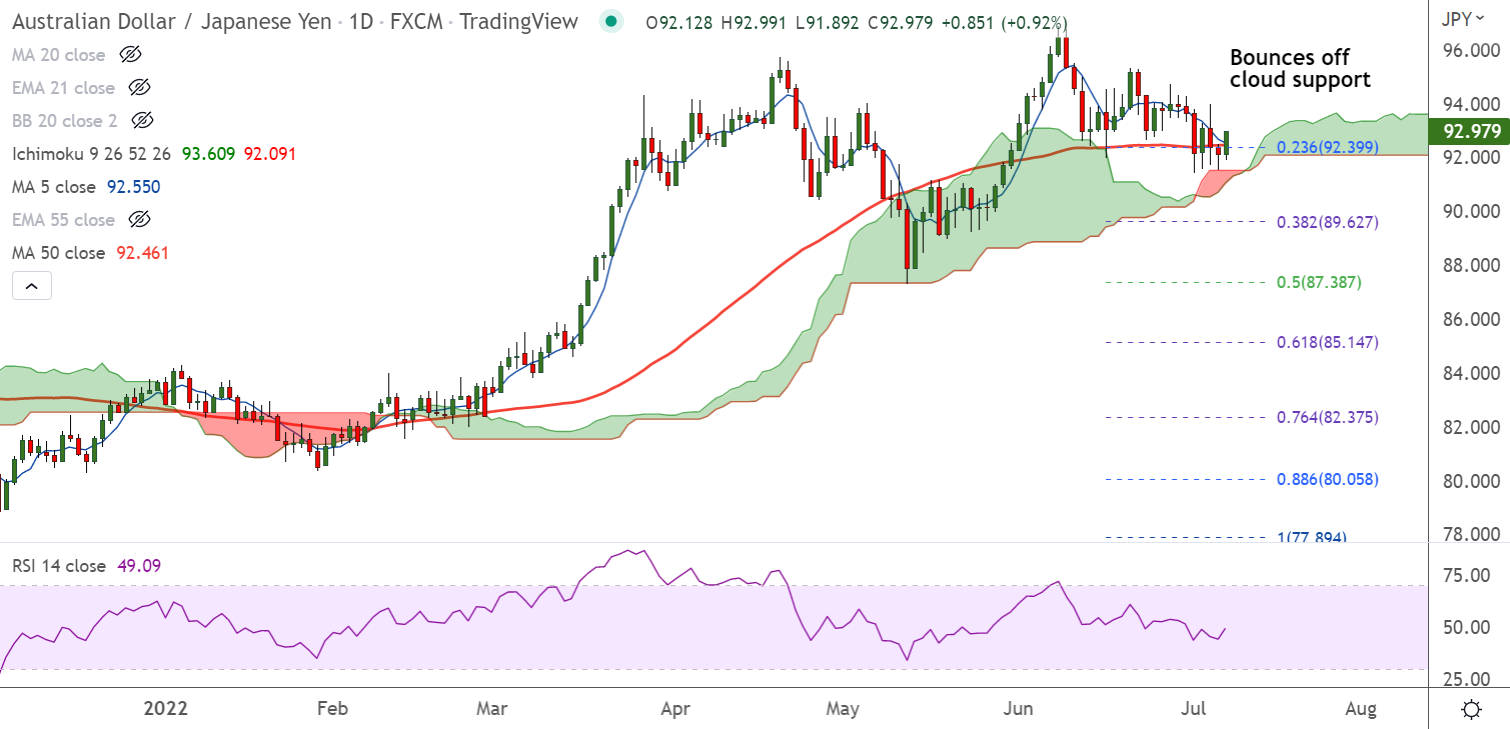

Chart - Courtesy Trading View

AUD/JPY was trading 0.98% higher on the day at 93.02 at around 10:20 GMT, scope for further gains.

Aussie Trade Balance, Exports and Imports improved during May, supporting the Australian dollar.

Australia’s Trade Balance rose to 15,965M in May versus 10,725M expected and 10,495M prior.

Further, Exports rose 9.5% from 5.0% prior and Imports grew 5.8% compared to the previous contraction of 0.8%.

Improvement in iron-ore prices lent additional support. The most-traded iron ore on the Dalian Commodity Exchange climbed 5% to 764 yuan ($114.02) a tonne as of 04:29 GMT.

That said, recently higher covid numbers from Shanghai and mass testing in Beijing renew China lockdown fears and keep upside limited.

The pair trades pivotal at 21-EMA resistance, break above could see further upside in the pair.

Support levels - 92.55 (5-DMA), 92.46 (50-DMA)

Resistance levels - 93.11 (200H MA), 93.20 (21-EMA)

Summary: AUD/JPY pivotal at 21-EMA resistance. Watch out for decisive break above for further gains.