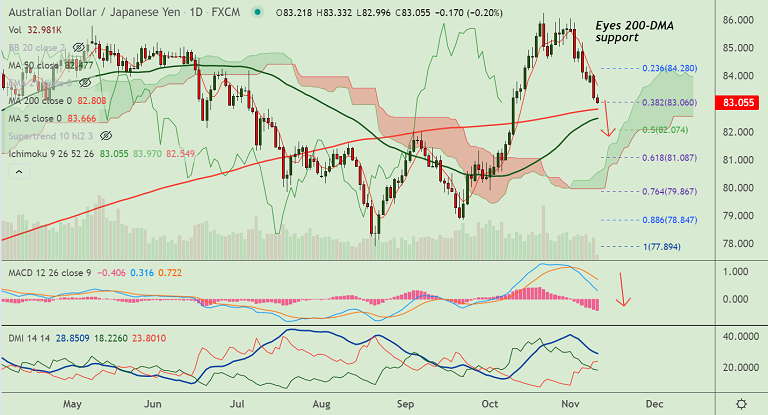

AUD/JPY chart - Trading View

AUD/JPY was trading 0.20% lower on the day at 83.04 at around 06:10 GMT, outlook bearish.

Australian dollar fails to cheer better-than-expected China's inflation data, remains depressed amid risk-off sentiment.

China’s key inflation data for October released early Wednesday showed both CPI and PPI beat expectations and prior readings.

China’s headline Consumer Price Index (CPI) rose past 1.4% market consensus and 0.7% previous readings to 1.5% YoY.

The Producer Price Index (PPI) refreshed a multi-month high with the 13.5% yearly figure compared to 12.4% expected and 10.7% prior.

Risk-off market mood, firmer US Treasury yields exert additional downside pressure on the pair.

Technical indicators support weakness in the pair, momentum is strongly bearish and volatility is high.

Major Support Levels:

S1: 82.97 (55-EMA)

S2: 82.80 (200-DMA)

S3: 82.45 (110-EMA)

Major Resistance Levels:

R1: 83.66 (5-DMA)

R2: 84.04 (21-EMA)

R3: 84.28 (23.6% Fib)

Summary: AUD/JPY trades with a bearish bias. 200-DMA at 82.80 in sight.