Chart - Courtesy Trading View

Spot Analysis:

AUD/JPY was trading 0.99% lower on the day at 82.35 at around 10:10 GMT

Previous Week's High/ Low: 83.33/ 81.54

Previous Session's High/ Low: 83.83/ 83.03

Fundamental Overview:

The risk-off impulse boosted the safe-haven JPY and prompted aggressive selling around AUD/JPY.

Putin authorized a special military operation in Donbas and triggered a fresh wave of the global risk-aversion trade.

Focus remains on fresh headlines on the situation in Ukraine, which will influence price action.

Technical Analysis:

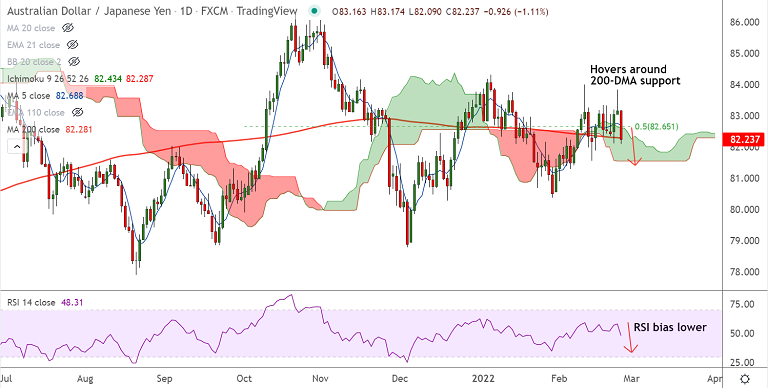

- AUD/JPY has re-entered into the daily cloud

- Price action is holding 200-DMA and 110-EMA support around 82.28

- The pair has formed an 'Inverted Hammer' in the previous session

- Price has slipped below 200H MA and GMMA shows bearish shift on the intraday charts

Major Support and Resistance Levels:

Support - 82.28 (200-DMA), Resistance - 82.75 (200H MA)

Summary: AUD/JPY shows bearish shift on the intraday charts. Breach below 200-DMA to plummet prices.