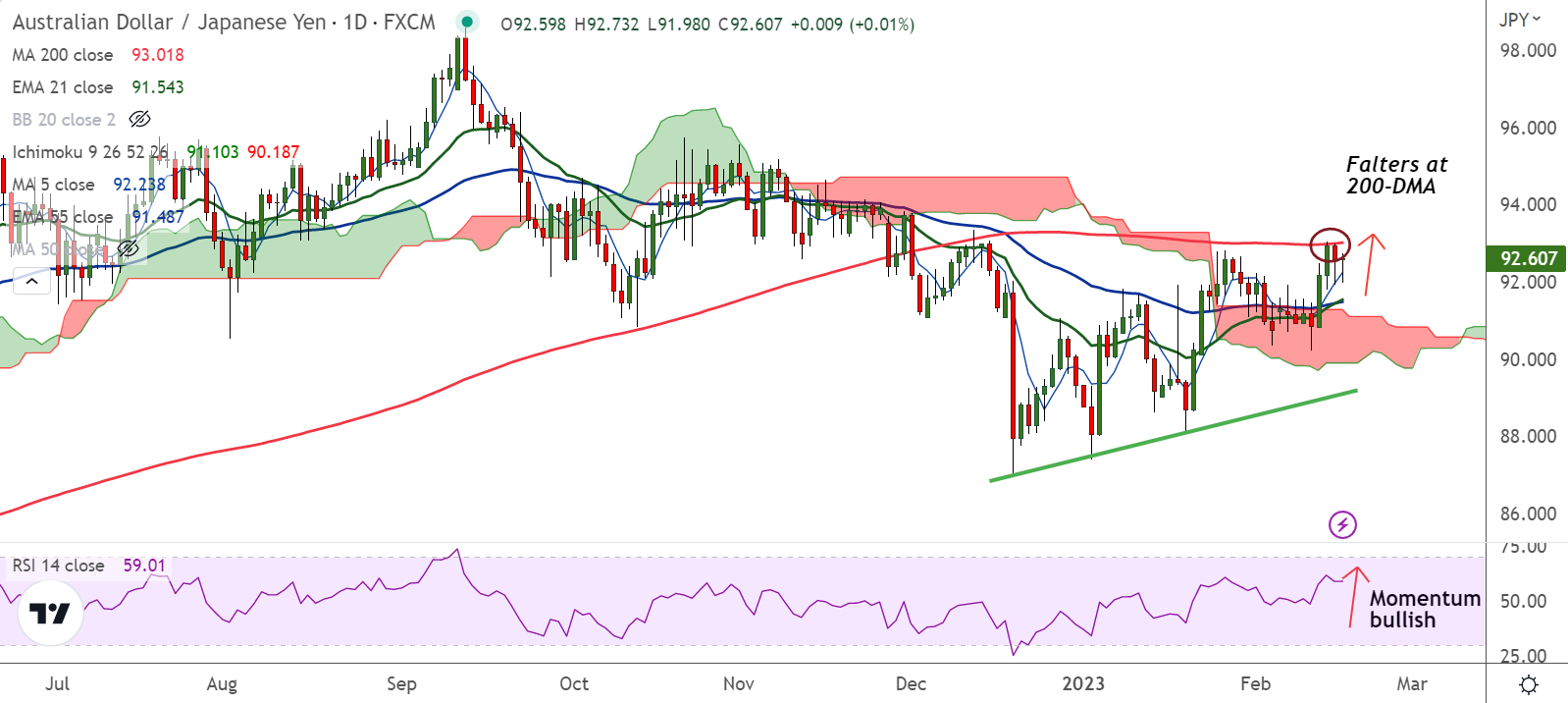

Chart - Courtesy Trading View

AUD/JPY was trading largely unchanged at 92.60 at around 10:10 GMT, up from session lows at 91.98.

The pair finds stiff resistance at 200-DMA at 93.01, decisive break above required for upside continuation.

Data released by the Australian Bureau of Statistics showed the number of employed people in the country fell 11,500 in January to 13.7 million, compared to expectations for growth of 20,000 people.

The unemployment rate was up to 3.7% from 3.5% in the prior month, its highest level since June. Australia’s participation rate fell to 66.5% in January from 66.6% in the prior month.

Earlier in the day, Australia’s Consumer Inflation Expectations for February also eased to 5.1% versus 5.6% market forecasts and previous readouts.

Weakness in the jobs market gives the RBA less economic headroom to keep raising interest rates, likely to limit gains in the AUD.

On the other side, Japan January trade deficit improved to ¥-3,496.6B versus ¥-3,871.5B expected and ¥-1,451.8B prior (revised).

Exports grew 3.5% versus 0.8% expected and 11.5% previous readings while the Imports eased to 17.8% versus 18.4% market forecasts and 20.7% prior.

Elsewhere, Japan’s Machinery Orders rose by 1.6% MoM versus 3.0% expected and -8.3% prior.

Upbeat Japanese trade data stoked fresh calls for hawkish moves from the Bank of Japan (BoJ).

Fundamentals suggest weakness in the pair. Technical indicators point to some gains, but 200-DMA is proving to be tough resistance.

Support levels - 92.23 (5-DMA), 91.92 (110-EMA)

Resistance levels - 93.01 (200-DMA), 94

Summary: AUD/JPY upside falters at 200-DMA. Watch for retrace below 110-EMA for more weakness. Decisive break above 200-DMA will change near-term dynamics.