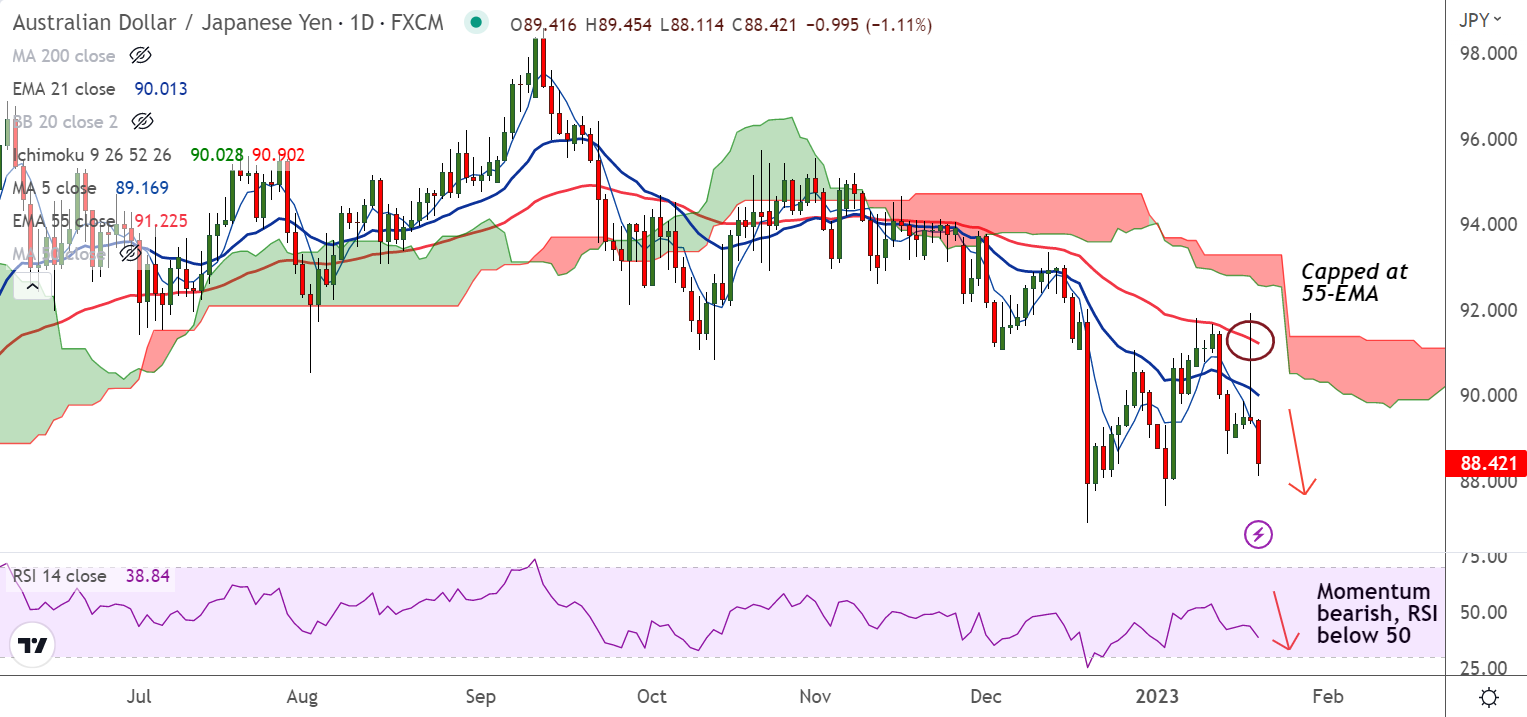

Chart - Courtesy Trading View

Spot Analysis:

AUD/JPY was trading 1.11% lower on the day at 88.42 at around 12:55 GMT.

Previous Week's High/ Low: 91.82/ 88.62

Previous Session's High/ Low: 91.91/ 89.33

Fundamental Overview:

Aussie dampened across the board after the release of weaker-than-expected December employment data earlier on Thursday.

Australia's labor market shrunk by 14.6K employees in December, while markets were expecting fresh addition of 22.5k jobs.

Further, the Unemployment Rate jumped to 3.5% against the consensus and the former release of 3.4%.

One weak employment report is unlikely to derail the Reserve Bank of Australia's (RBA) policy tightening path.

Traders now focus on the interest rate decision by the People’s Bank of China (PBoC), which is scheduled for Friday.

The risk-off mood benefits the safe-haven JPY and acts as a headwind for the pair.

Technical Analysis:

- GMMA indicator shows major and minor trend are bearish

- The pair has formed a long-legged inverted hammer on the previous candle

- MACD confirms bearish crossover on signal line

- Momentum is strongly bearish, Stochs and RSI are sharply lower

Major Support and Resistance Levels:

Support - 87.99 (Lower BB), Resistance - 89.16 (5-DMA)

Summary: AUD/JPY trades with a bearish bias. Dip till 110-week EMA at 87.21 likely. Further weakness only on break below.