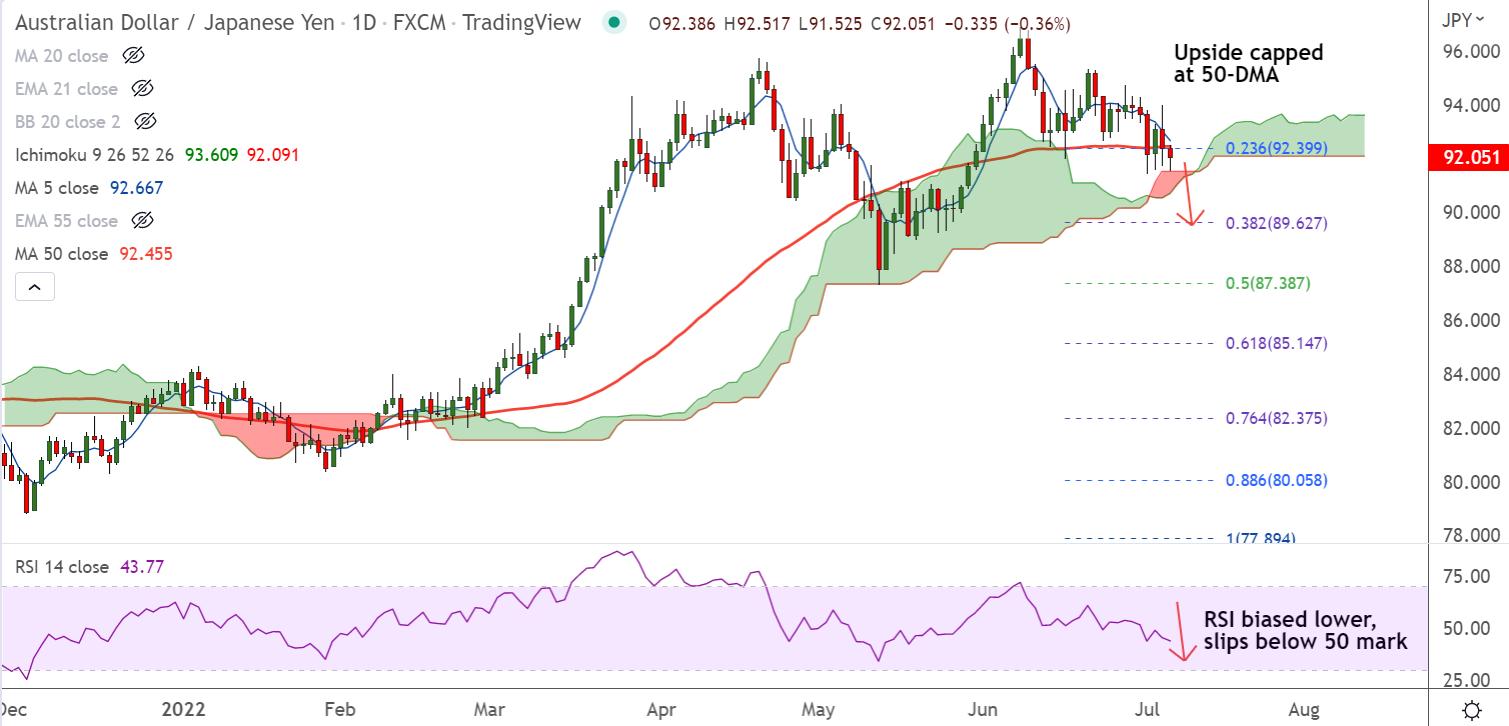

Chart - Courtesy Trading View

Technical Analysis:

- AUD/JPY was trading 0.28% lower on the day at 92.13 at around 12:50 GMT

- The pair is extending weakness from multi-year highs at 96.88 hit last week

- Downside has held support at daily cloud, break below will drag the pair lower

- Momentum is bearish, Stochs and RSI are biased lower, RSI is below 50 mark

- Price action is below 200H MA and GMMA indicator has turned bearish on the intraday charts

Support levels - 90.99 (20-week MA), 90.34 (110-EMA)

Resistance levels - 92.35 (55-EMA), 93.22 (21-EMA)

Summary: AUD/JPY bias remains bearish as long as pair holds below 55-EMA. Technical indicators are bearish. Scope for test of 110-EMA at 90.34.