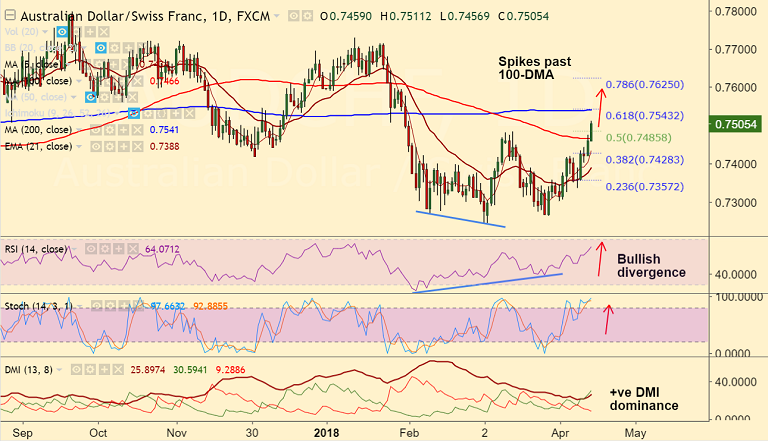

- AUD/CHF spikes past 100-DMA, hits 3-month highs at 0.7511 before paring some gains to currently trade at 0.75 levels.

- Aussie buoyed on Friday after the Reserve Bank of Australia's (RBA) Financial Stability Report (FSR).

- RBA's FSR stated that the risks from high-household debt and aggressive bank lending practices have slightly abated of late.

- The pair is trading 0.65% higher on the day, scope for further upside.

- Technical support gains. RSI shows strong upside momentum at 64 levels and Stochs are biased higher.

- Next bull target aligns at 200-DMA at 0.7541. Break out at 200-DMA could propel the pair higher.

- We see weakness only on close below 21-EMA at 0.7388.

Support levels - 0.7485 (50% Fib), 0.7466 (100-DMA), 0.7434 (5-DMA)

Resistance levels - 0.7541 (200-DMA), 0.76, 0.7680 (major trendline)

Recommendation: Good to go long around 0.7480/90, SL: 07430, TP: 0.7540/ 0.76/ 0.7680

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at 150.961 (Bullish), while Hourly CHF Spot Index was at -94.0652 (Bearish) at 1035 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.