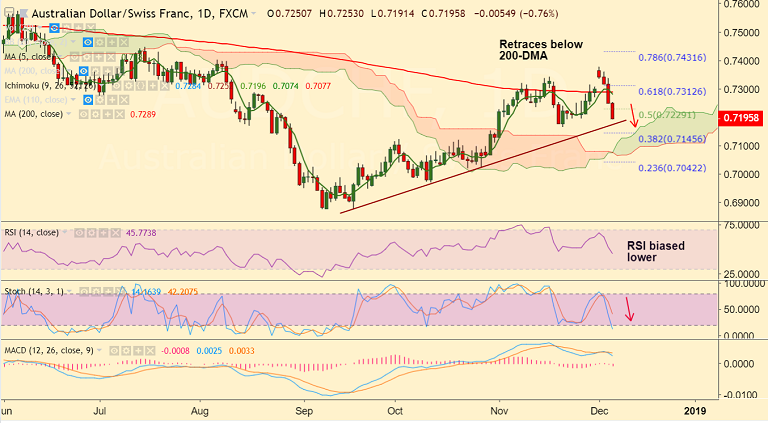

AUD/CHF chart on Trading View used for analysis

- AUD/CHF is trading 0.71% lower on the day at 0.7199 at the time of writing.

- The pair has retraced break above 200-DMA and is extending declined for the 4th straight session.

- Aussies weakens across the board after series of poor data which has strengthened RBA stance to stay pat.

- After dismal Q3 GDP showing on Wednesday, Australia's Trade Balance unexpectedly declined in October.

- Data released earlier today showed Australia’s trade surplus narrowed to A$2.3 billion in October from A$2.9 billion the previous month.

- Traders largely ignored positive retail sales which were up 0.3% m/m in Oct versus a +0.2% forecast and accelerating from the +0.1% in Sept.

- Technical indicators have turned bearish on daily charts, RSI and Stochs are sharply lower.

- The pair has broken below 110-EMA and is holding support at 55-EMA at 0.7193. Break below will see further weakness.

- On the flipside, immediate resistance is seen at 23.6% Fib at 0.7258. Bullish continuation only above 200-DMA.

Support levels - 0.7193 (55-EMA), 0.7166 (Lower BB), 0.7066 (61.8% Fib)

Resistance levels - 0.7243 (21-EMA), 0.7258 (20-DMA), 0.7282 (5-DMA)

Recommendation: Good to go short on decisive break below 55-EMA, SL: 0.7250, TP: 0.7165/ 0.71/ 0.7070

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays