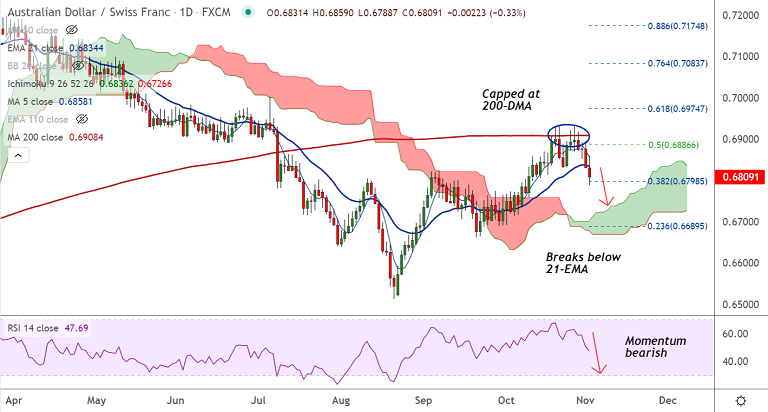

AUD/CHF chart - Trading View

AUD/CHF was trading 0.26% lower on the day at 0.6813 at around 10:30 GMT, outlook bearish.

The pair is extending previous session's slump, breaks below 21-EMA, scope for further weakness.

Australian dollar weakened on Tuesday after the Reserve Bank of Australia (RBA) dampened investor hopes for a hawkish tilt.

The RBA left its cash rate at a record low of 0.1%, dropped both a commitment to keeping bond yields low and its projection of no hike in interest rates until 2024.

Governor Lowe maintained the dovish tone in the statement that followed, said market pricing for early rate hikes extremely unlikely.

AUD/CHF trades with a bearish bias. Recovery was rejected at 200-DMA. Price action has slipped below 21-EMA.

MACD confirms bearish crossover on signal line. Oscillators are in neutral territory and biased lower.

Support levels - 0.6799 (55-EMA), 0.6775 (converged 50-DMA and 20-week MA), 0.6755 (Lower BB)

Resistance levels - 0.6834 (21-EMA), 0.6858 (5-DMA), 0.6908 (200-DMA)

Summary: AUD/CHF trades with a bearish bias. Bears eye 50-DMA support at 0.6775. Break below to see further downside.