We observed the pair has currently been unable to breach and sustain trend line resistance where prices were rejected at 0.9656. This shorting call was coupled with other bearish indications as well.

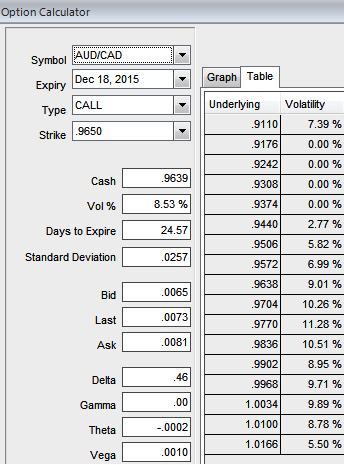

As shown in the diagram, the IV of AUDCAD is at 8.53% which is reasonable to enter into contract.

Low IV implies the market thinks the price will not move much. But on the contrary, Options with a higher IV cost more. This is intuitive due to the higher likelihood of the market 'swinging' in your favour. If IV increases and you are holding an option, this is good.

Hence, on speculation basis we recommend buying one touch binary vega puts in order to derive maximum leverage benefits, for the targets of 60-65 pips with strict stop loss of 30-35 pips which would act as a resistance again, thereby risk reward ratio would be 1:2.

By employing these ATM binary vega puts one can multiply the returns by twice, thrice or even pour returns unimaginably. But do remember this call is strictly on speculative grounds.

The prime merits of such one touch option spreads are high yields during high volatility plays, so one can use spreads as well when IV picks up during US sessions.

Wider spreads indicates lack of liquidity. The spreads for one touch AUD/CAD options are constant time and barrier levels.

Usually, such binary options for every change in 1 pip the relative change in option price 0.01% or even exponential at high implied volatility times.

FxWirePro: AUD/CAD option trade set up

Tuesday, November 24, 2015 10:32 AM UTC

Editor's Picks

- Market Data

Most Popular