Technical Analysis:

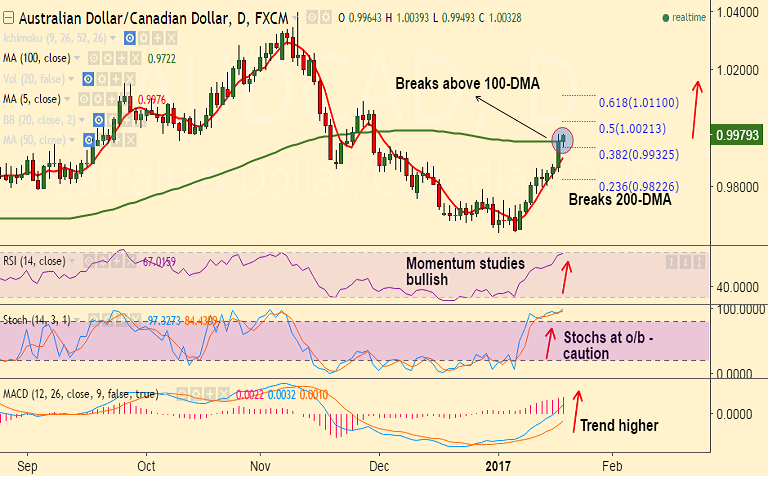

- AUD/CAD has broken major resistances - 50-DMA at 0.9872, 100-DMA at 0.9956.

- Momentum studies are bullish, we see scope for further gains.

- RSI strength at 69 levels, MACD and ADX confirm upside momentum.

- Next target for AUD/CAD bulls is 1.00 (50% Fib of 1.0397 to 0.9645 fall)

- Weakness only on close below 5-DMA at 0.9897.

Fundamental Factors:

- Unimpressive Australia labor market report could weigh on the Aussie, but markets currently shrug off jobs data.

- The Australian jobs data showed that the employment change arrived at +13.5 K vs the expected +10.0K and against the prior +37.1K

- The Unemployment Rate came in as 5.8% vs the expected 5.7% and against the prior 5.7%.

- On the other side, BoC held policy rate steady at 0.50% as broadly expected and said it expects the economy to expand 2.1% during the current year and 2018.

- BoC Governor Stephen Poloz said that rate cut remains on the table if downside risks materialize.

TIME TREND INDEX OB/OS INDEX

1H Bullish Neutral

4H Bullish Overbought

1D Bullish Neutral

1W Bullish Neutral

Support levels - 0.9956 (100-DMA), 0.9932 (38.2% Fib of 1.0397 to 0.9645 fall), 0.9896 (5-DMA)

Resistance levels - 0.9982 (Jan 18 high), 1.0021 (50% Fib), 1.0095 (Nov 28 high)

Call Update: Our previous call (http://www.econotimes.com/FxWirePro-AUD-CAD-on-track-to-test-50-DMA-at-09885-good-to-go-long-on-dips-487643) has achieved all targets.

Recommendation: Book partial profits. Raise trailing stops to 0.9890, target: 1.00/ 1.0020/ 1.0095

Fresh longs can be entered on dips around 0.9937, SL: 0.9880, TP: 1.00/ 1.0020/ 1.0095

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at 74.7285 (Bullish), while Hourly CAD Spot Index was at -157.498 (Highly bearish) at 0430 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.