NZD OTC market functions are likely to intensify contemplating upcoming RBNZ OCR cut in its monetary policy by 25 bps to keep it at 2.00%. As a result of this speculation in the FX market, the New Zealand dollar moved lower sensing more bearish pressures in the weeks to come especially after data showed that China’s imports dropped far more than expected last month and as the greenback remained supported by Friday’s strong U.S. jobs data.

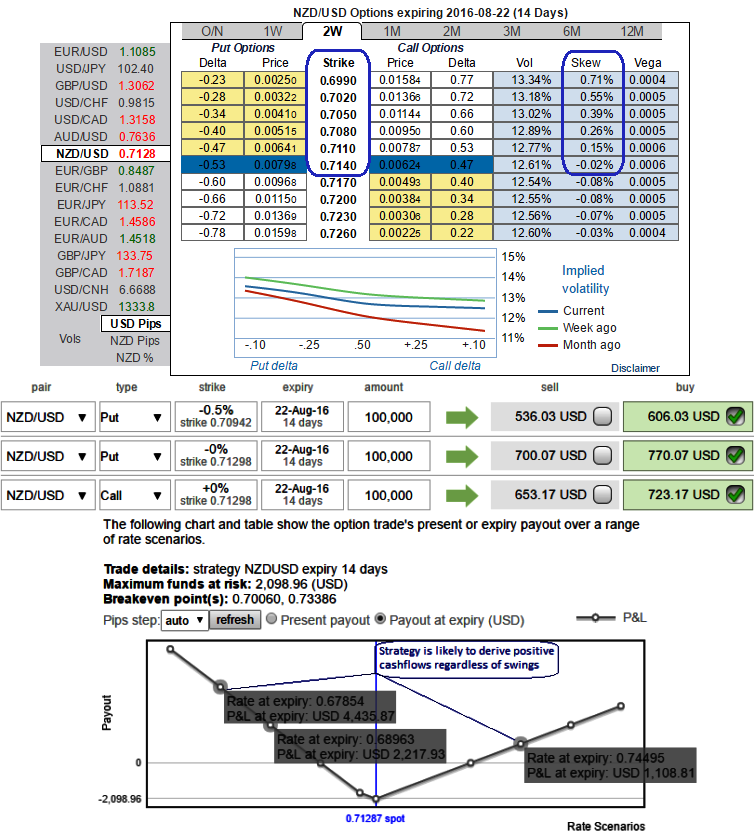

Well, to mitigate this FX risk, at spot reference 0.7131 we consider the NZDUSD options strips with narrowed strikes as shown in the diagram on higher IV skews. These skews in 2W IVs signifies the OTC market interests in OTM put strikes. Even if the underlying spot goes against our anticipation, the underlying risk is properly mitigated regardless of swings. As you can probably understand from the payoff function, the strategy can also be utilized on speculating grounds as it is likely to fetch certain yields.

Scenario 1: What if NZDUSD moves down:

OTM leg of put to become first ATM and then go into in the money. The puts we deploy were not very far off from the ATM strike and cheap too (because OTM contracts). In terms of percentage, they will increase very fast. The call will decrease in value – but it will first become ATM and then go OTM.

A 100 point movement can bring in good profits. Because when you book profits and sell the call you will still get a good premium. You are already making good profits from the puts. Result: Not a big loss from the call, and great profits from the puts as a result of more proportion of puts (1:2) it gives leveraging effects to the portfolio.

Scenario 2: What if underlying stays in range:

When spot FX remains between strikes of 0.7007 and 0.7339, the implied volatility of 1W ATM put with a delta of -0.49 and 1W ATM call with a delta of 0.5 is above 12.5%. Since 1W ATM IVs of this pair have been higher with positive skews; any small change in underlying would lead exponential premium growth in the above instruments but are unlikely to fetch adverse results.

Usually whatever movement has to come it comes in near term (3-4 days per say) after any significant news.

Then the news dies down and normal trading begins. Which indirectly means there is no point in waiting after those 3-4 trading days. Sell all options bought and book loss/profits.

Scenario 3: What if underlying moves up:

The call option would be ITM but seems unlikely, because it has a healthy delta, premiums would spike faster but underlying spot should move substantially to show remarkable results. The two put options bought will lose value fast, but this call option will be bringing in profits. Though its only 1 lot, you may have to wait for some time to book profits.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close