NZD traders focus shifted onto RBNZ that is scheduled to announce its monetary policy after the inflation expectations in New Zealand decreased to 2 pct in the Q4’2017 from 2.10 pct in the Q3’2017, while the GDT-TWI fell 3.5%, with the WMP price index down 5.5%. NZDUSD attempted but failed, to break above the 0.6950 level, with a stronger USD and softer commodity price performance (for dairy but more generally as well) weighing.

We expect the RBNZ to still be somewhat cautious tomorrow, perhaps disappointing a market looking for a slightly more hawkish tone. But downside moves in kiwi should be limited.

RATES: Yesterday was a day of (at least partial) reversal for the local bond market after the dramatic response to the postponement of NZDMO’s April 2029 bond syndication. A bias to steepen the curve could remain, although markets will be reluctant to push things too far ahead of the RBNZ decision.

Circumstances around tomorrow's RBNZ meeting are the polar opposite:

If the RBNZ remains firmly on hold, as we expect, and the US dollar rises on the delivery of a Fed interest rate rise in December, then NZDUSD should fall to 0.67 by year-end.

NZD has taken a severe beating around the election results, investor pre-positioning is heavily received NZ rates and short NZD, and risks are that the Bank delivers a less-dovish-than-expected statement.

Bearish scenarios: Expect NZDUSD to slide below 0.67 if:

1) The housing market slowdown becomes disorderly

2) The migration rolls over due to a shift in government policy;

3) NZ bank funding issues intensify, causing the market to question NZ's ability to attract capital inflow.

Bullish scenarios: See underlying spot FX to bounce back above 0.72 given:

1) Fiscal easing and the increase to the minimum wage drive broader wage inflation and gains in household income, boosting the inflation outlook;

2) Falling global term rates take some pressure off local mortgage rates, allowing the housing market to recover.

OTC Outlook and Options Trade Recommendations:

All the factors stated above seem to be discounted in FX options market, please glance through nutshell evidencing IV skews that signify hedger’s bearish interests in next 2-months timeframe. Positively skewed IVs of this tenor signal underlying spot FX is expected to be lowering southwards as the skews have been well balanced flashing positive numbers on OTM strikes.

Also be noted that at spot reference: 0.6909, the 2m skews are targeting OTM put strikes at 0.67, accordingly, we advocate buying 2m (1%) out of the money put.

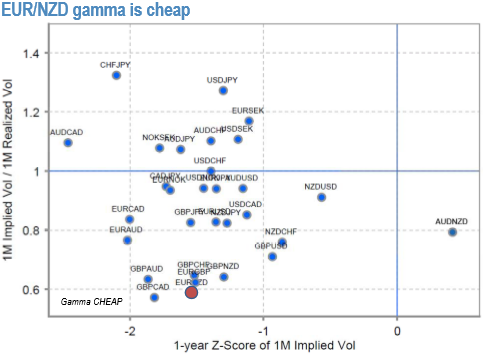

While EURNZD is the NZD-cross that screens the best value in gamma to benefit from such a turn of events (refer above chart; 2W ATM 8.1 vs. hourly realized vol 1-wk 9.0, 4-wk 9.5) and is worth holding the event.

Directional plays for a tactical NZD bounce could take the form of either 1M 1.64 EUR put/NZD call one touch (5X gearing off spot ref. 1.6705) or 1M 1.671.65 put spread (3.5X).

Our RBNZ outlook (on hold throughout 2018) is anchoring short-maturity interest rates and should keep 2yr swap rates in a 2.10% to 2.50% range, as long as inflation remains below 2%. Longer maturity rates will largely follow US rates.

EURNZD spot fx price curve has continued to prolong its bearish swings, tumbled from the highs of 1.7215 to the current 1.6707 levels.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 19 levels (which is neutral) ahead of RBNZ’s OCR announcement, we expect the RBNZ to still be somewhat cautious tomorrow, perhaps disappointing a market looking for a slightly more hawkish tone. While hourly USD spot index was at shy above -21 (neutral) while articulating (at 06:58 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

http://www.fxwirepro.com/invest

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says