There has been substantial FX market moves over the past month and this has led to some changes in the ranking of currencies on this framework.

The positive momentum of the FOMC minutes for the US dollar did not last long. Despite the fact that market observers seemed to agree that the US central banker’s assessments are much more optimistic based on the minutes than both the statement of the meeting and Fed chair Jay Powell had suggested in the press conference. The reserved reaction of USD exchange rates suggests that most had assumed a slightly less pronounced change of direction on the part of the Fed and that this was more or less confirmed by the minutes.

Contrary to the dollar the euro is very much moved by the monetary policy outlook. That is likely to be due to the fact that the economic situation in the eurozone seems much more critical at present than in the US, the market is likely to increasingly expect expansionary ECB measures, which would put further significant pressure on the euro.

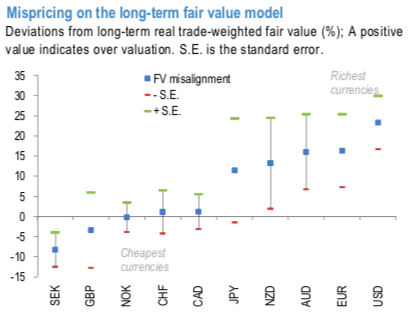

On the cheaper end of the spectrum, following SEK’s notable underperformance over this period, SEK now screens as the cheapest currency on this framework. Meanwhile, GBP outperformance over the same period has nudged the currency closer to fair value (refer 1st chart). While GBP valuations are not at an extreme yet, SEK’s undershooting is now approaching decade-lows and may indicate some limits to how much recent underperformance can extend (refer 2nd chart).

The ranking is relatively unchanged on the rich end of the spectrum, with USD, EUR and the Antipodean FX still featuring on that list. Among the funding currencies, CHF is the only one near fair value, with USD the richest, followed by EUR and JPY. Yet, None of these valuations are at an extreme indicating that movement in either direction is possible.

While the richness of the Antipodean FX has come off the peak, both AUD and NZD continue to look overvalued relative to the G10 petro-FX. Both NOK and CAD continue to be near fair value on this framework (refer 3rd chart).

Positive news as regards the trade negotiations between the US and China, and in addition a strong Australian labor market report. As a result, the extent of the collapse in AUD this morning comes as somewhat of a surprise. In particular, as it is said to have been initially triggered by an Australian bank lowering its growth outlook and now forecasting two RBA (Reserve Bank of Australia) rate cuts this year. Courtesy: JPM & Commerzbank

Currency Strength Index: FxWirePro's hourly EUR is at 37 (mildly bullish), hourly USD spot index is inching towards -39 levels (mildly bearish), hourly AUD is at -120 (highly bearish) while articulating at 13:05 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data