NZDJPY has experienced an abrupt steep spike up from 79.984 to 82.300 today to break the 81.004 support levels.

Use these rallies for a capital gain by deploying butterfly spreads strategy, when your maximum profits are when the stock hits the middle strike price at expiration. Use when you are expecting low volatility in the stock price.

Execution: Currently, NZDJPY spot FX is trading at 82.037.

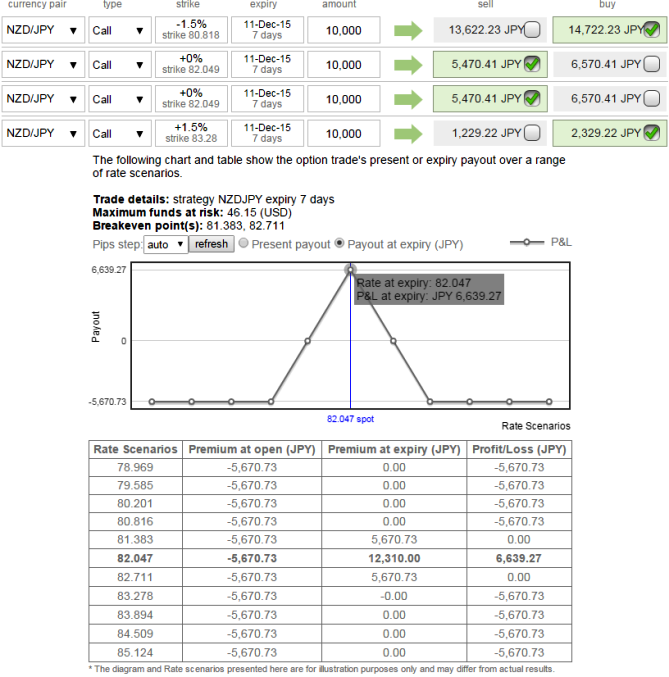

Let's visualize that we've executed the strategy as shown in the diagrammatic representation,

Buy 1W an (1.5%) out of the money strike call for JPY 2331 and one more 1W (1.5%) in the money call for $14728, simultaneously, sell 3D two lots of at the money strike calls at JPY 5473.12. Thereby, we can enter into this strategy for a net debit.

Risk/Reward: Risk is maximum to the extent of the net debit of the bought and sold options. The reward is the difference between the lower and middle strikes minus the net debit.

Positive cash inflow: For very little cost, benefit when the pair moves sideways or upwards.

Net Upside: Middle strike price minus lower strike price minus net debit.

Break Even Point: Lower strike plus net debit.

Effect of Time Decay: Positive when the position is profitable and negative when the position is unprofitable.

FxWirePro: A run through on modified call butterfly spread on NZD/JPY

Friday, December 4, 2015 11:59 AM UTC

Editor's Picks

- Market Data

Most Popular