Norges Bank was the main event of focus in the recent past. The central bank of Norway left its key policy rate steady at 0.75 percent on January 24th2019, which is in line with market consensus. Policymakers said that the outlook and the balance of risks imply a gradual increase in the policy rate. Global growth is a little weaker than projected, and there continues to be considerable uncertainty surrounding developments ahead. In Norway, economic growth and labor market developments appear to be broadly as projected, while inflation has been slightly higher than expected. The central bank reinforced the policy rate would most likely be raised in March 2019.

The outcome was largely in line with our expectations their outlook on the economy is little changed since December and they continue to expect that a hike will occur in March, consistent with the baseline. The fly in the ointment was that the bank pointed to considerable uncertainty around the global outlook, but this was not unexpected given soft regional growth and ongoing trade conflict.

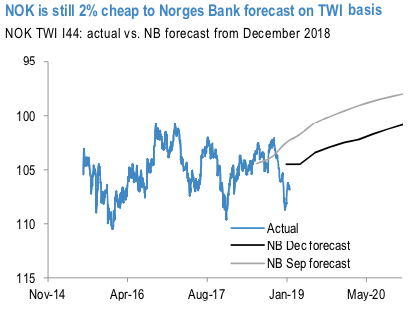

There are still two months between now and the March meeting (March 21) for the central bank to assess the impact of global uncertainties. Without improvement, it would be reasonable to expect a dovish hike (i.e. with a flatter trajectory for future hikes), but with the currency still 2% cheap relative to NB forecast, we continue to find value in long NOK trades (refer above chart).

NOK longs are expressed tactically vs SEK given that we expect the Norges Bank to be the next Scandi central bank to be in play (next rate hike from NB is expected to be in March, while the next one from the Riksbank is slated for 2.

Bought NOK/SEK outright in early January at around 1.0334 levels. Stop at 1.01. Marked at + 2.80%. Courtesy: JPM & Tradingeconomics

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -22 levels (which is mildly bearish), hourly USD spot index was at 32 (bullish) while articulating at (13:54 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says