The Fed meeting starts today but the decision will not be announced until tomorrow evening. Ahead of that May US data for housing starts and building permits will provide updates on what is a particular interest rate sensitive sector. We expect starts to be unchanged after a big rise in April but forecast a modest increase in permits.

USDJPY is dipping below 108.250 level to wrap up this week. As we head into this week, major central banks (BoJ and Fed) are the center of attraction as they are scheduled for their respective monetary policies, on Wednesday, and there is a higher-than-usual degree of uncertainty.

The central banks put are starting to knock in. ‘Can BoJ be open for policy change or most likely to maintain negative rates on hold’ is the interesting question. The BoJ would be in focus for now and we expect them to follow in the footsteps of other DM central banks and turn more dovish, which should still be conducive of selling USDJPY downside.

On the flip side, we expect the Fed to initiate 75bp of precautionary rate cuts this year, beginning with a 50bp reduction in July, followed by a 25bp reduction in September.

The USD may initially rally if the constellation of events fails to meet the market's high bar for a dovish delivery, though we'd fade any rally. A formal signal in the FOMC statement of the Fed's attentiveness and reactivity to a deterioration in the outlook, perhaps driven by trade tensions, would suggest the market pricing in a greater risk premium for lower rates, which would be USD negative.

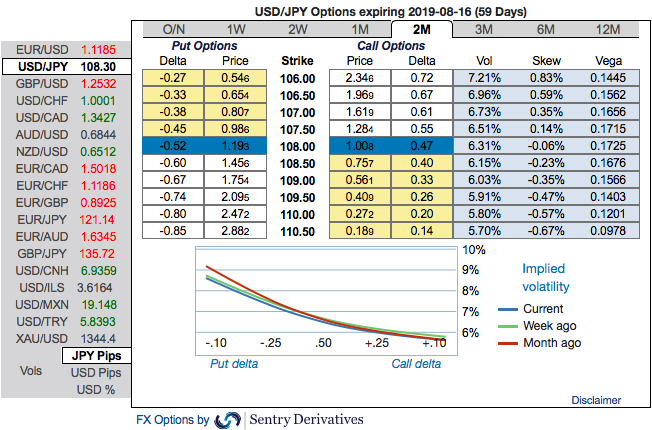

USDJPY OTC update and options strategy as follows:

Please be noted that the positively skewed IVs of 2m tenors are signifying the hedging interests for the bearish risks. We see bids for OTM strikes up to 106.00 levels. This indicates hedgers’ interests in OTM put strikes, overall, put holders are on the upper hand.

While negative risk reversal numbers of USDJPY across all tenors are also substantiating downside risks amid any momentary upswings in the short-run.

OTC positions of noteworthy size in the forex options market can stimulate the underlying forex spot rate. The spot may trend around OTM put strikes as the holders of the options will aggressively hedge the underlying delta.

USDJPY fell from 112.166 to the recent lows of 107.815 levels, the defensive yen has been the top performer of the day. We feel quite fortunate to be exiting in the black having owned USDJPY through a deep and sometimes volatile correction in US stocks.

Trade recommendations: USDJPY spiked from 107.815 the recent lows to the current highs of 108.596 levels, the defensive yen are still on the cards. We feel quite fortunate to be exiting in the black having owned USDJPY through a deep and sometimes volatile correction in US stocks.

Hence, at spot reference of USDJPY: 108.28 levels, we advocate buying a 2M/2w 110/107.00 put spread ahead of Fed and BoJ monetary policies (vols 6.61 vs 6,89 choice), wherein short leg is likely to function if the underlying spot FX keeps spiking, we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds. The lower/shrinking implied volatility is good for options writer and increasing realized volatility is good for the bearish trend. Hence, the above strategy seems to be the best suitable in prevailing volatile conditions. Courtesy: Sentry & Saxo

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at 114 levels (which is highly bullish), while hourly USD spot index was at 85 (bullish) while articulating at (09:21 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data