The current views on the NZ economic outlook have become more nuanced. While we retain a broadly constructive view of the medium-term growth picture, we have turned more circumspect near term, and see a heightened chance of a growth wobble (in fact we have cut our near-term GDP forecasts).

That wobble is not expected to turn into something longer-lasting, but it certainly marks us out as less upbeat than the likes of the Treasury and RBNZ. Above-trend growth is hard to achieve when the most cyclical part of the economy (housing) looks set to remain soft.

That has obvious implications for both the outlook for tax revenue and monetary policy, although the picture is complicated by inflation risks that are shifting higher.

Our RBNZ outlook (on hold throughout 2018) is anchoring short-maturity interest rates and should keep 2yr swap rates in a 2.10% to 2.50% range, as long as inflation remains below 2%. Longer maturity rates will largely follow US rates.

OTC Outlook and hedging strategies:

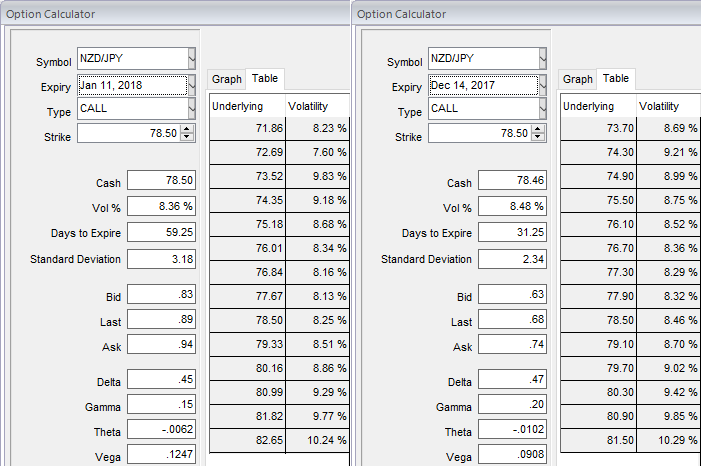

ATM IVs of NZDJPY is trading between 8.50% and 8.36% for 1 and 2m tenors respectively.

Please also be noted that the options with a higher IV cost more which is why in this case OTM puts have been preferred over ATM instruments. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favour. If IV increases and you are holding an option, this is good. When you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

Thus, conservative hedgers can prefer the below strategy:

Debit Put Spread = Go long 2M ATM -0.49 delta Put + Short 1m (1%) OTM Put with lower Strike Price with net delta should be at -0.40.

For a net debit, bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Moreover, the risk is capped to the extent of initial premium paid, as opposed to unlimited risk when short selling the underlying outright.

However, put options have a limited lifespan. If the underlying FX price does not move below the strike price before the option expiration date, the put option will expire worthless.

Aggressive bears can bid NZDJPY 1m IVs & RR buy 75 NZDJPY OTM put of near-month tenors.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -129 levels (which is bearish), while hourly JPY spot index was at shy above -6 (neutral) while articulating (at 08:56 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand