Today, ECB president Draghi’s speech is scheduled which is due to testify about the euro-area economy and central bank’s monetary policy before the European Parliament Economic and Monetary Affairs Committee, in Brussels.

The Governing Council will discuss its reinvestment policy at the next two meetings. We will give an overview of the most important aspects. The ECB has already signalled an unchanged orientation towards the capital key. We consider an operation twist along the lines of the Fed unlikely.

However, the ECB is likely to invest more in long-term bonds. In addition, the ECB will probably refrain from the restriction on reinvesting in maturing government bonds in the same country.

At its last meeting in mid-September, the ECB decided to halve its bond purchases as of October and held out the prospect of stopping purchases at the end of the year.

However, according to the ECB, "an ample degree of monetary accommodation" is still required. The central bank emphasized that monetary policy support is provided by the Forward Guidance on the ECB's key interest rates and by "the sizeable stock of acquired assets and the associated reinvestments". As a result, there is much discussion in the markets as to exactly how the ECB's reinvestment policy might look like.

Bearish EURJPY scenarios:

1) ECB delays hiking until 2020 as growth and core inflation struggle.

2) Excessive fiscal loosening in Italy (2.5-ppt+),

5) PM Abe steps down

Bullish EURJPY scenarios:

1) Euro-area growth rebounds to 2.5-3% by end -2018;

2) ECB becomes more comfortable with progress on wages and core inflation and softens its calendar guidance for hikes.

While Euro vol is more sensitive to the ebb and flow of Italy headlines, JPY is more levered to contagion from an escalation of trade tensions. Even absent these risks, there are good reasons for directional yen ownership – structural under-valuation, susceptibility to hawkish BoJ policy tweaks.

Options trade tips:

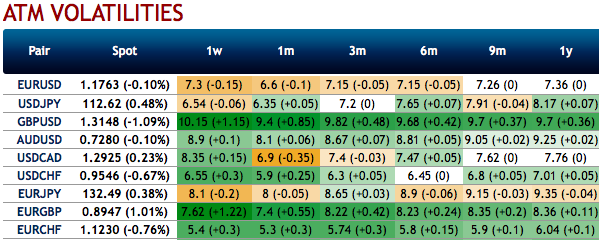

Buy 2m EURJPY ATM -0.49 delta puts for aggressive bears on hedging grounds. If expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1.

Buy 2M EUR puts/JPY calls vs. sell 2M 28D EUR puts/KRW calls for directional traders. Source: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 111 levels (which is bullish), while hourly JPY spot index was at -49 (bearish) while articulating at (10:06 GMT). For more details on the index, please refer below weblink:

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?