We already stated in our recent write up that, USDCAD was trading higher and hits 6- week highs owing to the fragile Canadian economic data. The pair has broken-out the major resistance 1.2600 and heading for 1.2675 marks where the next stiff resistance is observed.

Canadian retail sales numbers missed the consensus, dropped by 0.7% MoM in Aug which is well below the forecast of 0.3% increase and core CPI came in at 0.2% MoM below expectations of 0.3%. The weak data will stop the further increase of interest rate by BOC. The policy divergence between BOC and US Fed will take the USDCAD to next level till 1.2675/1.28 mark.

While the crude prices are inching higher on increasing geopolitical tensions in Iraq. The Brent futures aims above $57.75, while the WTI CFDs are trading above $52 mark and is facing major resistance at $52.40, Any break above $52.40 will take the oil to next level till $53/$53.75.

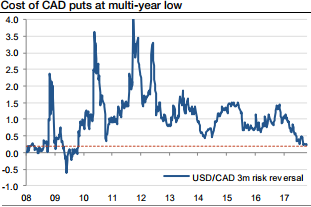

CAD skew at multi-year low, unlike Brent skew, in the options space, CAD volatility remains stuck at the lows, and we identify an appealing skew opportunity.

After the Canadian dollar’s sharp rise this year, USDCAD risk reversals have been under heavy pressure, reaching their lowest level since 2009 (refer above chart).

This makes CAD puts historically cheap, with a 3m skew that is almost flat. Interestingly, the USDCAD skew has evolved in line with the skew of Brent options (cross-asset vols can be easily compared via our Volhub Anywhere analytics), but they disconnected recently.

Oil puts remain expensive compared to cheaper CAD puts (refer above chart).

If this has been the case, take the opposite position in the underlying market. In this case, sell oil against CAD. It’s that simple. It has now been shaped a Delta hedge on your Put option.

Please be informed that the Delta of your option will change as the underlying market moves. To keep a perfect neutral Delta hedge, you would need to constantly adjust your position in the underlying market. To do this every time the market moves is an impossible task and the spread charges will eat up your profit.

Currency Strength Index: FxWirePro's hourly CAD spot index has been weaker after last Friday’s feebler Canadian CPI and retail sales data, inching towards -57 levels (which is bearish), while hourly USD spot index was at shy above 74(bullish) at the time of articulating (at 11:37 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One