The CNY is one aspect of the wider trade tensions and PBoC would need to tread meticulously. On a bilateral basis, CNY is down around 6% vs USD year-to-date but on a trade weighted or CFETS basis, it is down only around 3%. This suggests USD strength is one reason be- hind USDCNY’s rise. Nevertheless, US officials will keenly track the pace of CNY weakness from here.

PBoC’s mid-point fix today was also set above 6.90 for the first time since May-2017. Are we about to see a sustained bout of CNY weakness and shift in PBoC’s policy stance? Probably not as this may incur the wrath of the US.

CNY FX is perceived as a tool in a confrontational trade war scenario: We have squared-off existing long in SGD and THB FX positions against the USD over the past ten days on the assumption of an adverse US-China trade conflict. Although we continue to shy away from being short these currencies or for that matter KRW and TWD given the starting point of current account balances and valuations. CNY FX is different to these other currencies in that it does not enjoy the aforementioned supportive factors any longer. In an adverse trade war, CNY will likely bear a part of the policy adjustment.

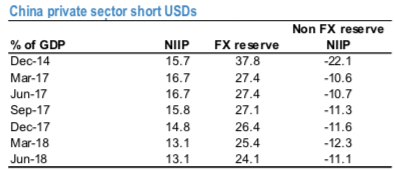

A bounded trade expression: We are activating a position in paid 3x6 CNH forwards (180 pips vs 3mth outright at 315 pips). The private sector is short USDs even though some of the imbalances moderated in 2Q’18 (refer above chart) and higher capital outflows could cause forward points to rise as has been the experience in 2015 and late 2016 / early 2017. The trade expression is a bounded one and not an outright short CNY one because every base-line scenario carries a tail risk and there is always a possibility that the trade tensions moderate in intensity or are spread over time. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly CNY spot index is inching towards 129 levels (which is bullish), hourly USD spot index was at -41 (bearish), while articulating (at 15:06 GMT). For more details on the index, please refer below weblink:

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics