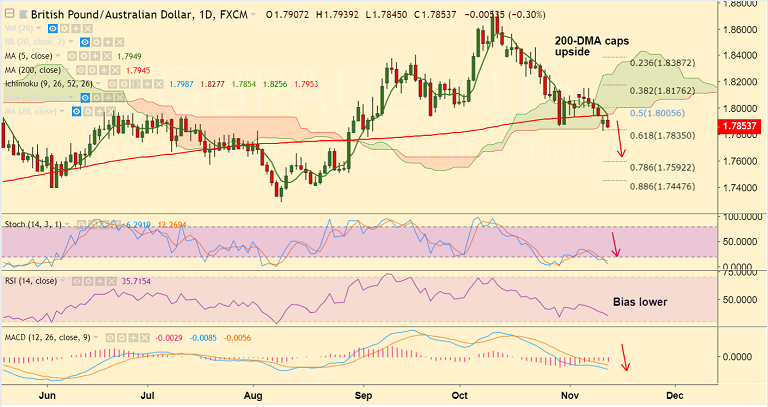

GBP/AUD chart on Trading View used for analysis

- GBP/AUD bounces off 61.8% Fib support to close in the green on Monday's trade.

- The pair however remains capped below 200-DMA and we see further upside only on break above.

- Brexit woes continue to plague the British pound. Theresa May looks to have suffered numerous setbacks over the weekend.

- Brexit headlines are going to feed the volatility in sterling over the coming days. GBP/AUD set to continue last week's declines.

- Momentum studies are bearish, Stochs and RSI sharply lower, MACD supports downside.

- Next major bear target below 61.8% Fib lies at 1.7665 (July 9 low). Violation there could see further weakness.

- On the flipside, retrace and close above 200-DMA could see some bounce back.

Support levels - 1.7835 (61.8% Fib), 1.7776 (Lower BB), 1.7665 (July 9 low), 1.7592 (78.6% Fib)

Resistance levels - 1.7945 (nearly converged 5 and 200-DMA), 1.80 (50% Fib)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-GBP-AUD-declines-for-6th-straight-week-slips-below-200-DMA-eyes-618-Fib-stay-short-on-upticks-1456523) has hit TP1.

Recommendation: Book partial profits at lows. Watch for break below 61.8% Fib for further weakness.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand